The decision to hike the cash rate was unanimous as the RBA produces a more hawkish tilt in their decision today. While the decision to hike in itself isn't surprising, it is more so the language that is accompanying the decision that is moving markets. The RBA went from trying to sell a narrative of two-sided risks in December to completely siding with needing to deal with higher inflation pressures now and perhaps for the year ahead.

This was their statement on forward guidance back in December last year:

"The recent data suggest the risks to inflation have tilted to the upside, but it will take a little longer to assess the persistence of inflationary pressures. Private demand is recovering. Labour market conditions still appear a little tight but further modest easing is expected. The Board therefore judged that it was appropriate to remain cautious, updating its view of the outlook as the data evolve."

And they shifted from that to this one today:

"A wide range of data over recent months have confirmed that inflationary pressures picked up materially in the second half of 2025. While part of the pick-up in inflation is assessed to reflect temporary factors, it is evident that private demand is growing more quickly than expected, capacity pressures are greater than previously assessed and labour market conditions are a little tight.

The Board judged that inflation is likely to remain above target for some time and it was appropriate to increase the cash rate target."

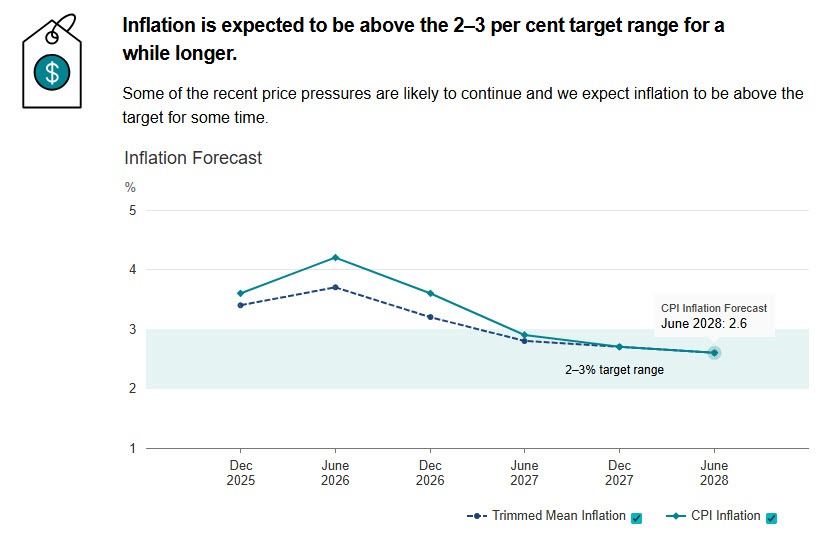

The key point is highlighted in bold as the RBA now forecasts inflation to be higher for an extended period of time, even if they continue to view that the underlying drivers impacting price pressures may only be temporary.

Besides that, their cash rate assumption also shows no signs of further easing and instead reflects more rate hikes in due time.

At the balance, this does not seem like a central bank that is still weighing up monetary easing. The fact that even with projected rate hikes in their forecast above, it's still borderline in getting inflation back into their target band.

I would take that as a rather hawkish sign and an implicit tell that perhaps they could be hiking rates sooner rather than later instead.

I mean, it could be a one-and-done until they get more evidence of changes to the inflation picture. However, it is clear that they are almost surely done with the easing part of the cycle already.

On inflation developments, the RBA argued two key points:

- Capacity pressures are judged to have contributed to high underlying inflation but are unlikely to explain the majority of the recent increase

- The larger part of the resurgence in inflation is judged to reflect some sector-specific demand and price pressures, which may not persist

- However, the overall judgement is very uncertain

To put it more plainly, this rate hike is mostly to deal with capacity pressures. But for further rate hikes to come along, the threshold is likely to be much higher. That of course subject to inflation developments.

So, how are markets reacting?

The Australian dollar is catching a modest bid, with markets previously only pricing in ~78% odds of a rate hike coming into the decision today. A more hawkish tilt also lays out the potential for more rate hikes to come, with cash rate futures now showing ~41 bps of rate hikes to follow after this one.

For some context, traders were only pricing in ~57 bps of rate hikes (including the one for today) before this.

AUD/USD is trading back up to above 0.7000 now and is up over 1% on the day. The jump higher not only takes out the figure level but pushes back above the 100-hour moving average (red line) of 0.6997. The firm break back above the key near-term level now sees the bias turn more bullish again for the pair.

A bit of a dollar recovery might still cap gains to start the week but all else being equal, the aussie looks well positioned for a continued move higher this year. That especially if global growth holds up and we see a rebound back in precious metals/commodities eventually.

And the RBA is definitely playing a helping hand in becoming the first major central bank to complete the pivot back to rate hikes.