Australian consumer confidence slumped again in February, strengthening the case for an RBA pause in March, though analysts still see a May rate hike if inflation stays sticky.

Summary:

Australian consumer sentiment fell for a third straight month in February, sinking deeper into pessimistic territory.

Higher interest rates and cost-of-living pressures are weighing heavily on household finances and spending intentions.

Expectations of further mortgage rate increases are now widespread among consumers.

Analysts say weak confidence supports an RBA pause in March as policymakers wait for quarterly CPI data.

Westpac still expects a further 25bp rate hike in May if underlying inflation remains elevated.

Australian consumer confidence deteriorated further in February, underscoring mounting pressure on households as higher interest rates compound ongoing cost-of-living strains.

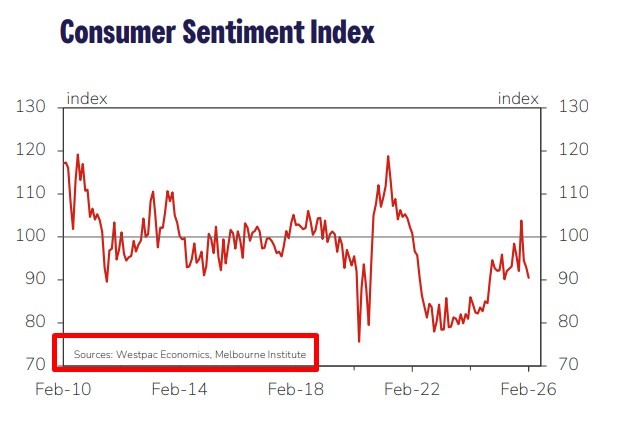

The latest Westpac–Melbourne Institute survey showed consumer sentiment fell 2.6% in February, to 90.5, extending the decline to a third consecutive month and taking the index well below the neutral 100 level. Analysts say the cumulative drop since November, a huge fall of 12.8%, highlights a sharp shift in household mood following the Reserve Bank of Australia’s first rate increase in more than two years.

Measures of family finances recorded a notable deterioration, while assessments of the broader economic outlook also weakened. In a concerning signal for retailers, willingness to purchase major household items fell sharply, suggesting discretionary spending is likely to remain under pressure in coming months.

The survey also showed households increasingly expect borrowing costs to rise further, reinforcing caution around big-ticket purchases and housing affordability. Analysts argue this growing expectation of higher mortgage rates risks becoming self-reinforcing, weighing on confidence even before additional tightening occurs.

Against that backdrop, economists see limited urgency for the Reserve Bank of Australia to move again at its March meeting. While policymakers have left the door open to further rate increases, analysts say the more likely outcome is a pause as the Board waits for clearer guidance from quarterly inflation data.

The RBA has previously flagged that volatility in the new monthly CPI reduces its usefulness for policy decisions, placing greater emphasis on quarterly measures of underlying inflation such as the trimmed mean. With the next quarterly CPI update due in late April, analysts expect policymakers to reassess the outlook then.

Economists at Westpac argue that inflation is still likely to prove uncomfortably high in that release, pointing to a further 25 basis point rate hike in May. As a result, markets continue to balance near-term weakness in consumer demand against a central bank still focused on restoring price stability.