Reserve Bank of Australia Governor Lowe is speaking at Australia's National Press Club in Sydney.

The topic of his speech is

- Monetary Policy, Demand and Supply

Headlines via Reuters:

- Decision to hold rates steady does not imply interest rate rises are over

- Board expects that some further tightening of monetary policy may well be needed

- Prudent to hold rates steady this month to allow more time to assess impact of past increases

- At our next meeting, we will again review the setting of monetary policy and updated forecasts

- Board is conscious monetary policy operates with a lag, of economic uncertainties

- Pause is consistent with our practice in earlier rate cycles

- Was common to move rates multiple times, then wait for a while and move again if necessary

- Increasingly clear higher interest rates are having an impact on household spending

- Wage outcomes have been consistent with inflation returning to target

- Recent high inflation has not been driven by excessive wages growth

- Inflation has not been driven by ever-widening profit margins

- While supply-side factors are influencing how fast inflation declines, they cannot be a reason to tolerate higher inflation on an ongoing basis

- Banking stress is another headwind for the global economy

---

Yesterday from the Reserve Bank of Australia:

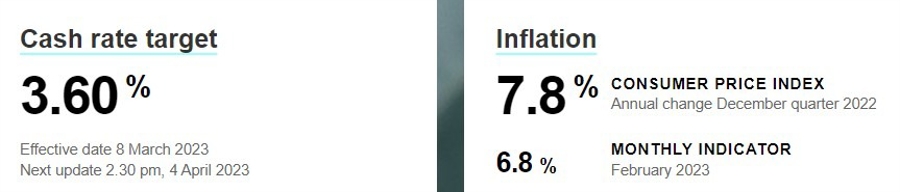

- RBA leaves cash rate unchanged at 3.60%, as expected

- Full statement of the RBA April 2023 monetary policy decision

- RBA heads to the sidelines, hints that rates may have or are close to peaking

- The aussie extends its post-RBA decline

The RBA's cash rate has been playing catch up the CPI.