Reserve Bank of Australia Governor Lowe in his final public speech as Governor. Deputy Governor Bullock takes over as the new head of the Bank on September 18.

The title of Lowe's speech today is "Some closing remarks". If you would like to listen live, the link is here.

- My recent focus is risk wages, profits run ahead of rates consistent with return to inflation target

- If this risk materialised and inflation became sticky, would require tighter monetary policy

- Will be difficult to return to the earlier world in which inflation tracked in a very narrow range

- Inflation is likely to be more variable around target

- Australia has been well served by a flexible inflation target

- Possible that Australia can sustain unemployment rates below what we have had over the past 40 years

- Now in an environment of stronger growth in nominal wages, which is positive

- The recent productivity record isn’t encouraging; solution fundamentally a political problem

- Interest rates influence housing prices, but are not reason Australia has some of the highest prices in the world

- Issue that defined my term more than any other was forward guidance on rates during the pandemic

- Guidance was widely interpreted as a commitment, rather than a conditional statement

- With the benefit of hindsight, my view is that we did do too much during pandemic

Lowe is holding on to the optionality of further rate rises if required. For the past 3 meetings, the Bank has held the cash rate unchanged at 4.1%. The next official quarterly inflation report is due on October 25, with a policy meeting following on November 7. If the inflation report is uncomfortable for the Bank the November meeting will be in play. Its unlikely we get a move before then.

AUD/USD is little changed after the Chinese trade data and Lowe's speech.

--

Full text is here:

--

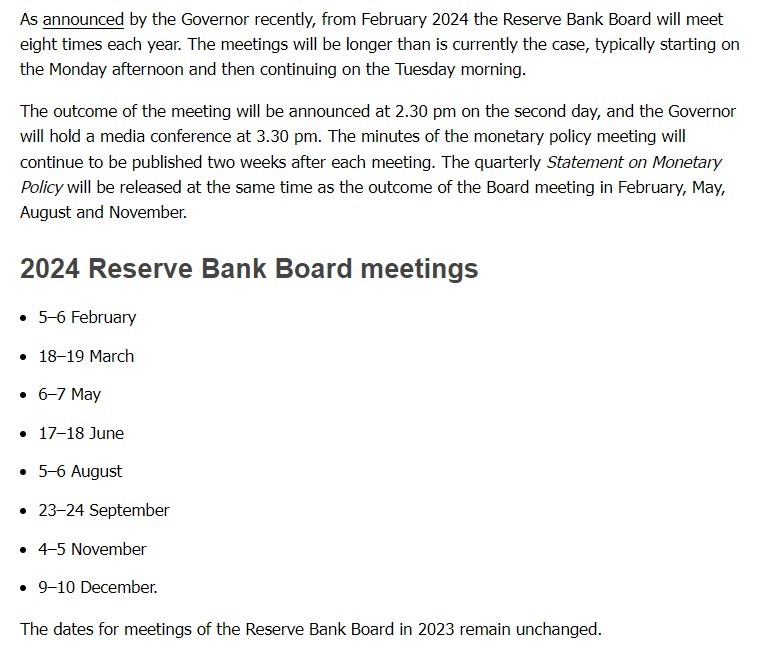

As a side note, in 2024 the RBA schedule of meetings will change significantly,