Economist/analyst consensus expectations for the Reserve Bank of Australia this year are for:

- +25 bp at the February (7th) meeting (ICYMI, there is no January meeting)

- +25 bp at the June (6th) meeting

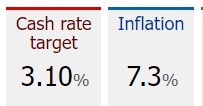

This'd take the Reserve Bank of Australia's Cash Rate target to 3.6% from its current 3.1%.

Goldman Sachs are an outlier, expecting 4.1% by June '23 (i.e. four 25bp rate hikes).

-

As for rate cuts, the median consensus is for the first cut in March 2024, although a third of the surveyed analysts project a cut some time in 2024.

Again Goldman Sachs is an outlier, seeing the RBA terminal rate of 4.1% still in place through to at least June of 2024.

-

I'm no PhD but, yeah, there is something wrong with this picture:

The RBA target band for inflation is 2 to 3%, at 7%+ there is much work to be done. And that Goldman Sachs may very well be closer to outcome than the consensus. If inflation remains sticky, that is.