Morgan Stanley on a Reserve Bank of Australia rate hike still to come:

- The RBA now appears comfortably in data-dependent mode, with little suggestion that it needs to front-load the tightening that is incorporated in its forecasts

- However, its inflation path suggests little room for surprises

- As such, we now expect a final rate hike at the next forecast update in November, lowering our terminal rate forecast from 4.60% to 4.35%. The risk to our forecast is a more extended period on hold.

Comments come after the RBA left its cash rate on hold again this month:

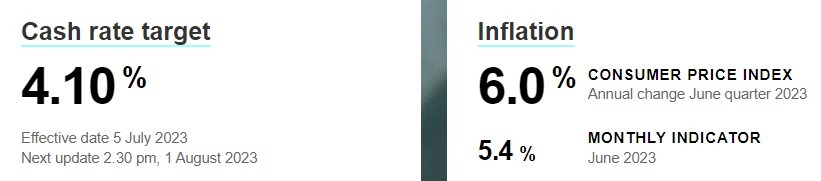

- RBA leaves cash rate unchanged at 4.10% for a second straight meeting

- ForexLive European FX news wrap: Aussie knocked lower by RBA

Of the big four banks locally here in Australia, only NAB expect another rate hike:

ANZ, CBA and Westpac all expect the RBA hiking cycle is over.

RBA cash rate vs. inflation