China will begin week-long holidays on Wednesday, local time. Ahead of that we have official and private PMIs due for release today. While the official PMIs are expected to show steady to a slight improvement, the private PMIs are expected a touch lower.

-

I've posted this info before, but ICYMi:

China has two primary Purchasing Managers' Index (PMI) surveys - the official PMI released by the National Bureau of Statistics (NBS) and the Caixin China PMI published by the media company Caixin and research firm Markit / S&P Global.

- The official PMI survey covers large and state-owned companies, while the Caixin PMI survey covers more small and medium-sized enterprises. As a result, the Caixin PMI is considered to be a more reliable indicator of the performance of China's private sector.

- Another difference between the two surveys is their methodology. The Caixin PMI survey uses a broader sample of companies than the official survey. Despite these differences, the two surveys often provide similar readings on China's manufacturing sector.

-

Also on the agenda is the 'Summary of Opinions' from the most recent Bank of Japan meeting. The meeting created some shock waves with two dissenters seeking an immediate rate rise.

And ... I've posted this info before, but ICYMI:

The Bank of Japan (BOJ) releases a "Summary of Opinions" after each monetary policy meeting. It serves as a record of the discussion and views of the Policy Board members on various economic and financial issues.

Key points about the Summary:

- The summary includes the views of the Policy Board members on economic conditions, both domestically and globally. This includes assessments of economic growth, inflation, and employment trends, among other indicators.

- The summary also outlines the Policy Board members' views on the effectiveness of the BOJ's current monetary policy measures, including interest rate policy, asset purchases, and yield curve control. Members may discuss the pros and cons of these policies and their potential impact on the economy.

- The summary includes discussions on the outlook for monetary policy and the potential risks to the economy. Board members may express their views on the appropriate timing and direction of future policy changes, as well as the potential impact of external factors such as global economic conditions.

- The summary also includes any dissenting views among the Policy Board members. If a member disagrees with the majority view on a particular issue, they may express their own opinion and rationale.

In a few week's time we'll get the Minutes of this meeting. The Minutes are a more detailed record of the discussions and decisions made during the meeting.

- The Minutes include a more complete record of the views expressed, including any dissents or alternative opinions that may not be included in the summary.

- The Summary of Opinions is typically released a few days after the policy meeting, while the Minutes are published about a month later. This means that the Summary of Opinions can provide more up-to-date information on the BOJ's current stance and view on the economy and monetary policy.

- The Summary of Opinions is usually written in a more accessible language, making it easier to understand the BOJ's views on monetary policy.

- The Minutes, on the other hand, are often more technical and may require a deeper understanding of economics and financial markets.

- The Summary of Opinions is typically shorter than the Minutes.

---

Also today we get the latest from the Reserve Bank of Australia. NO change to the cash rate is expected:

- CBA warn RBA path muddied as inflation risks rise. No cut this week, November cut in doubt

- RBA to hold rates at 3.60% next week, November cut hinges on Q3 CPI – Reuters poll

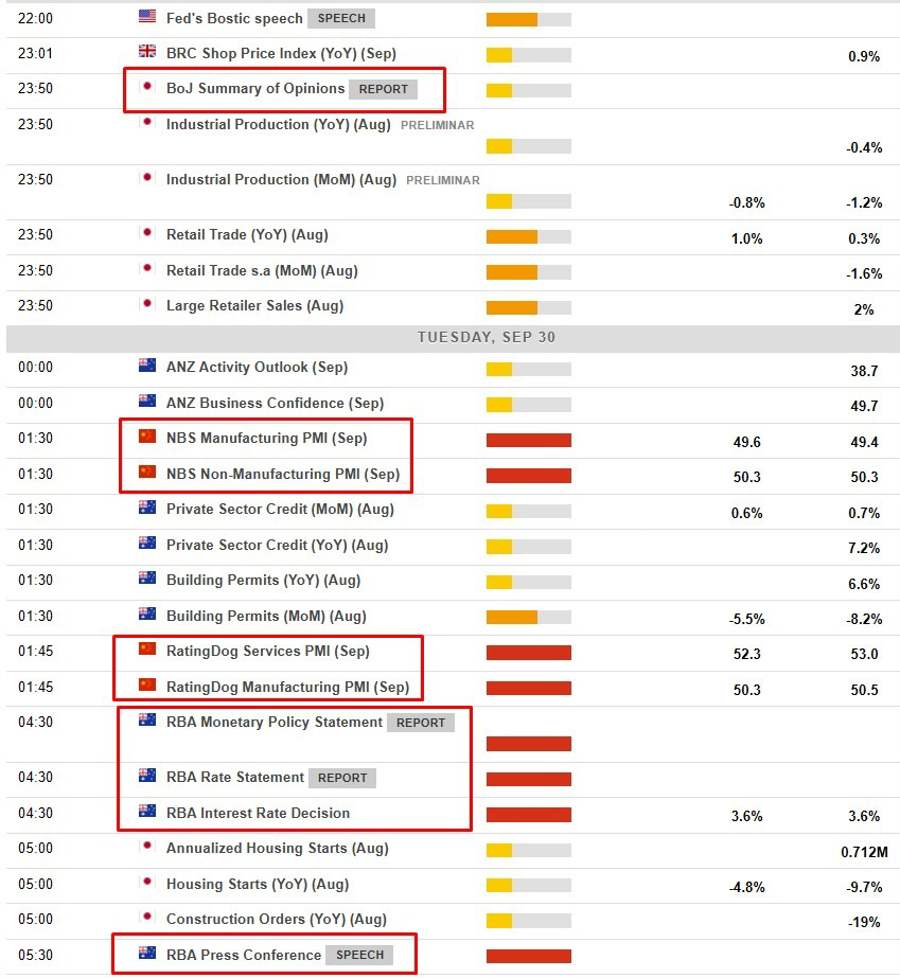

- This snapshot from the investingLive economic data calendar.

- The times in the left-most column are GMT.

- The numbers in the right-most column are the 'prior' (previous month/quarter as the case may be) result. The number in the column next to that, where there is a number, is the consensus median expected.