The two data points of note today are the GDP numbers from Australia for Q2 and also the private-survey services PMI from China.

Aussie economic growth is expected to have improved from Q1 but not set the world on fire.

The Chinese services PMI is what used to be known as the Caixin / S&P Global PMI. Caixin and no longer the sponsr though, now its ... wait for it ... the Ratings Dog/S&P Global PMI. Ratings Dog, yes, I'm not making this up. We've had official and private PMIs from China for August already:

- China Manufacturing PMI (August 2025) 49.4 (expected 49.5) Services 50.3 (expected 50.3)

- ICYMI - China data showed manufacturing sector contracted for a fifth straight month

- China S&P Global Manufacturing PMI (August) 50.5 (expected 49.5, prior 49.5)

Later we'll hear from Reserve Bank of Australia Governor Bullock

- Shann Memorial Lecture – Technology and the Future of Central Banking at the RBA – by Governor Michele Bullock, Perth

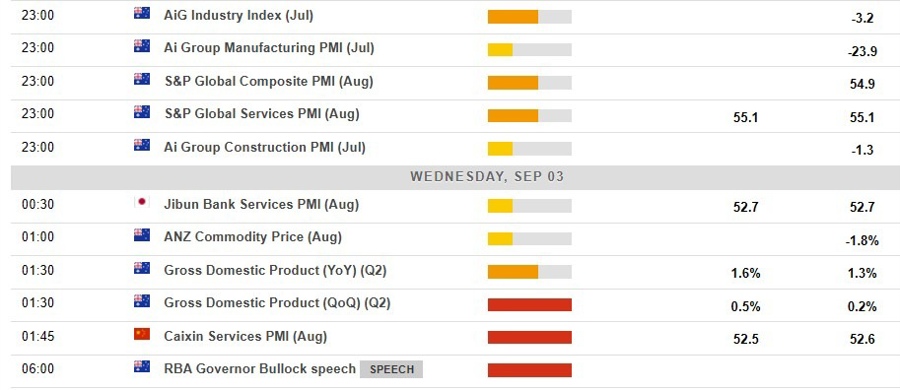

- This snapshot from the investingLive economic data calendar.

- The times in the left-most column are GMT.

- The numbers in the right-most column are the 'prior' (previous month/quarter as the case may be) result. The number in the column next to that, where there is a number, is the consensus median expected.