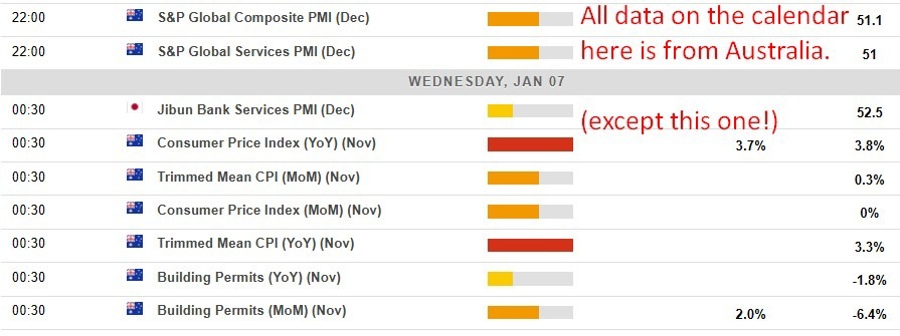

Its an active data agenda from Australia due today.

First listed are the S&P Global PMIs for December, the final readings for services and composite.However, let me save you some time ... these were out yesterday:

As I noted with this data:

- Sticky services inflation may complicate the RBA’s easing outlook despite softer growth signals.

Further to this, we'll get a better idea of how sticky inflation is today with the data due for November 2025. Australia’s CPI release is due in just a few hours (11.30 am local / 0030 GMT/ 1930 US Eastern time) and is shaping up as a key test for the near-term outlook on Reserve Bank of Australia policy. The data lands after a run of firmer-sounding commentary from RBA officials, which has nudged markets toward a more hawkish reassessment. Interest-rate pricing now implies roughly a 40% chance of a hike as early as February, driven by fears inflation may prove more persistent than policymakers would like:

Headline inflation is expected to show only modest improvement. Economists forecast November CPI easing slightly to around 3.7% year-on-year from 3.8% previously. However, attention is likely to remain firmly on underlying inflation, where progress has been slower. The trimmed mean CPI — the RBA’s preferred core measure — is widely expected to remain above the 2–3% target range, underscoring concerns that domestic price pressures are not yet cooling convincingly.

Recent data highlights the dilemma facing the central bank. While monthly headline CPI momentum has stabilised somewhat, services inflation and labour-driven costs remain sticky. Housing-related indicators, including building approvals, have been volatile, suggesting patchy momentum in the sector as higher borrowing costs continue to bite.

With inflation risks finely poised, today’s CPI report is set to be a critical input into market thinking on the RBA’s next policy step.

- This snapshot from the investingLive economic data calendar.

- The times in the left-most column are GMT.

- The numbers in the right-most column are the 'prior' (previous month/quarter as the case may be) result. The number in the column next to that, where there is a number, is the consensus median expected.