Summary:

ASX 200 flat as investors await CPI data

November CPI due Wednesday at 11:30am AEDT

Headline inflation seen easing, core pressures persist

Markets price ~39% chance of February rate hike

Bank stocks lag amid tightening risk

Australian equities traded little changed on Tuesday as investors adopted a cautious stance ahead of closely watched inflation data due later this week, with strength in mining stocks offset by weakness across rate-sensitive sectors.

The benchmark S&P/ASX 200 was marginally lower, down 0.03% at 8,726 in late trade, after closing almost flat in the previous session. Market participants largely refrained from taking fresh positions as attention shifted to Australia’s November consumer price figures, scheduled for release on Wednesday, January 7 at 11:30am local time (0030 GMT).

-

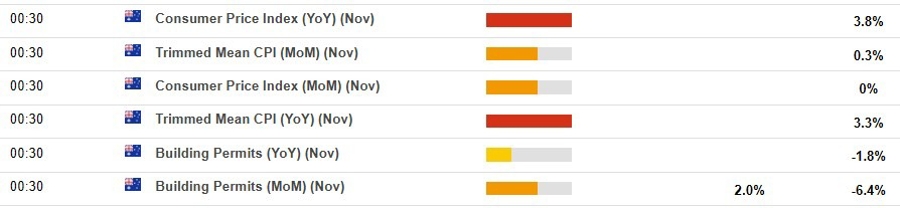

- This snapshot from the investingLive economic data calendar.

- The times in the left-most column are GMT.

- The numbers in the right-most column are the 'prior' (previous month/quarter as the case may be) result. The number in the column next to that, where there is a number, is the consensus median expected.

-

The upcoming CPI print is seen as pivotal for the near-term policy outlook at the Reserve Bank of Australia, particularly after recent commentary from policymakers struck a more hawkish tone. Markets are currently pricing around a 39% probability of an interest-rate hike as early as February, reflecting concerns that inflation may remain uncomfortably sticky.

Economists expect headline consumer price inflation to ease modestly in November to around 3.7% year-on-year from 3.8% previously. However, underlying measures are likely to remain elevated. The trimmed mean CPI, the RBA’s preferred gauge of core inflation, is expected to stay above the central bank’s 2–3% target band, reinforcing the view that domestic price pressures are proving slow to subside.

The breakdown of recent data highlights the challenge facing policymakers. While month-on-month headline CPI has shown signs of stabilisation, services inflation and labour-related costs remain firm. Building permit data has also been volatile, pointing to uneven momentum in housing-related activity amid tighter financial conditions.

In equity markets, rate-sensitive financial stocks underperformed as investors weighed the risk of further policy tightening. The financials sector slipped 0.6%, led by losses in the major banks. Commonwealth Bank of Australia fell 0.7%, while the other big lenders declined between 0.4% and 0.5%.

By contrast, mining stocks provided support to the broader index, benefitting from resilient commodity prices and a softer US dollar backdrop. Still, the overall tone remained defensive, with traders reluctant to commit ahead of an inflation release that could reset expectations for interest rates, bond yields and the Australian dollar.

With inflation expectations finely balanced, Wednesday’s CPI report is likely to play a decisive role in shaping market pricing for the RBA’s next policy move.