Summary:

Headline CPI slowed to 3.4% y/y, below expectations (more data here)

Monthly inflation flat at 0.0%

Trimmed mean eased to 3.2% y/y, still above target

Housing, food and transport remain key inflation drivers

Data supports RBA hold, not an imminent pivot to rate hikes (IMHO anyway)

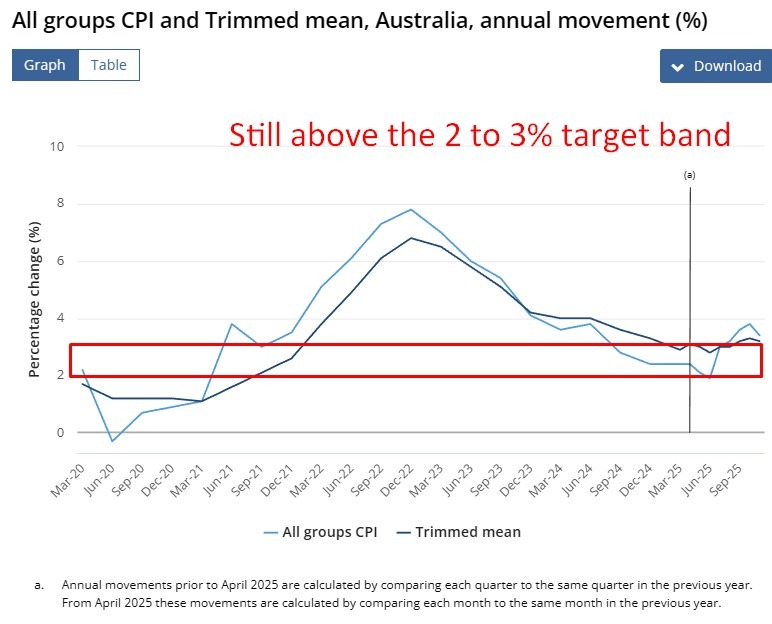

Australia’s inflation pulse softened in November, with headline price pressures easing more than expected, though underlying inflation remains uncomfortably firm for policymakers.

Data from the Australian Bureau of Statistics showed the Consumer Price Index rose 3.4% year-on-year in November, down from 3.8% in October and below market expectations of 3.7%. On a monthly basis, headline CPI was flat (0.0%).

Underlying measures also edged lower but remained elevated. The trimmed mean CPI, the Reserve Bank of Australia’s preferred gauge of core inflation, slowed to 3.2% y/y from 3.3%, broadly in line with expectations. On a monthly basis, trimmed mean inflation rose 0.3%, unchanged from October. The weighted median CPI also increased 0.3% m/m and stood at 3.4% y/y.

Housing remained the largest driver of annual inflation, rising 5.2% over the past year, followed by food and non-alcoholic beverages (+3.3%) and transport (+2.7%). These components continue to reflect elevated rents, insurance costs and services-related price pressures, even as goods inflation cools.

While November’s outcome marks a welcome step lower for headline inflation, the broader signal for policymakers is more nuanced. With two months of data now available, the trimmed mean for the December quarter still appears too firm to give the RBA immediate comfort that inflation is returning sustainably to the 2–3% target band. Services inflation and labour-linked costs remain sticky, limiting the scope for near-term policy easing.

Market reaction was measured. The Australian dollar initially dipped on the softer-than-expected headline print but quickly recovered to trade little changed, reflecting the balance between improving headline momentum and persistent core inflation.

Overall, November’s CPI supports the case for the RBA to hold rates steady for now, while reinforcing that policymakers will want clearer evidence of sustained easing in underlying inflation before shifting to an outright dovish stance.

Separately we had building permits data for November, 15.2% m/m

- expected 2.0%, prior -6.4%