A steady 4.1% jobless rate and another fall in total unemployment should keep rate hike risk priced, supporting AUD and holding front-end yields firm. It doesn’t force a March move, but it keeps the RBA’s finger on the trigger.

Summary:

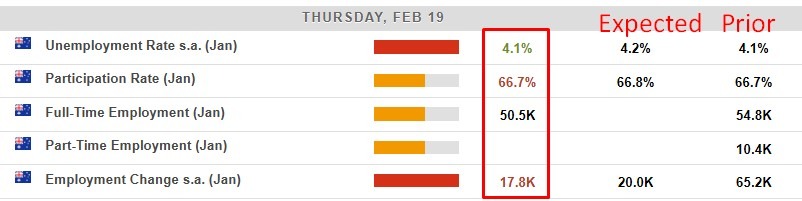

Employment rose 17.8k in January, broadly in line with expectations

Full-time jobs surged 50.5k, offset by a 32.7k fall in part-time roles

Unemployment rate steady at 4.1%, below RBA February forecasts

Hours worked climbed 0.6% m/m, signalling firm labour demand

Data do not lock in a March hike but tilt risks further toward tightening

Australia’s January labour force data delivered a broadly “as expected” headline but a firmer underlying message, keeping the Reserve Bank of Australia’s tightening bias alive.

Total employment rose by 17,800 in January, close to consensus forecasts near 20,000, and a clear step down from December’s outsized 65,200 gain. The more important detail was the composition: full-time employment surged 50,500, partly offset by a 32,700 decline in part-time roles. The skew toward full-time jobs points to resilient labour demand rather than an abrupt cooling.

The unemployment rate held steady at 4.1%, beating expectations for a slight lift to 4.2%. Participation was unchanged at 66.7%, marginally below consensus but stable enough to suggest labour supply is no longer adding upward pressure to unemployment. Adding to the “tight market” signal, hours worked rose 0.6% over the month — a solid increase that indicates employers are still utilising labour intensively.

A notable takeaway was the continued decline in the total stock of unemployed persons, which fell for a fourth consecutive month in January. The last time unemployment fell four months in a row was in the four months immediately before the RBA began its rate hiking cycle in May 2022. While the labour force survey is notoriously volatile, the persistence of this trend supports the argument that labour market slack is not building in a meaningful way.

For the RBA, the report does not lock in a March rate hike by itself, but it moves policymakers closer. The unemployment rate remains well below the RBA’s February Statement on Monetary Policy track, and there is nothing in the release to challenge the Bank’s assessment that labour market conditions are still relatively tight. If inflation pressures remain uncomfortable, these labour numbers leave the door wide open to further tightening.