The data is here:

It's the second month in a row of job losses.

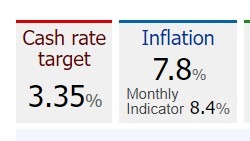

The Reserve Bank of Australia is in a bit of a bind here if job losses continue. The Bank does not want to tip Australia into recession, and it also needs to address shockingly high inflation . Its cash rate is deeply negative:

The Bank's hand was forced at its February meeting, surging inflation made the +25bp rate hike a sure thing, anything less than that would have been the Bank shirking its responsibility to stable prices.

Looking ahead, the next official quarterly CPI report, for Q1 2023, is due on April 26, although there will be two monthly inflation reports in by then. It's the quarterly data that is the 'official' account of inflation. By April 26 there will have been two further jobs reports (on March 16 and April 20).

If (IF!) monthly inflation comes in a little tamer the Bank may take this time, and incoming data, to assess and consider its next move. The Reserve Bank of Australia meetings ahead are:

- March 7

- April 4

- May 2

- (RBA meet the first Tuesday of each month except in January).

Anyway, back to the headline to the post, AUD/USD lower: