The propsect of another on hold decision from the Reserve Bank of Australia at its next meeting (May 2) has increased following the latest inflation data.

The RBA hiked rates 10 meetings in a row from May 2022 to March 2023 (the Bank meets once a month except in January). Then paused in April.

Today's data:

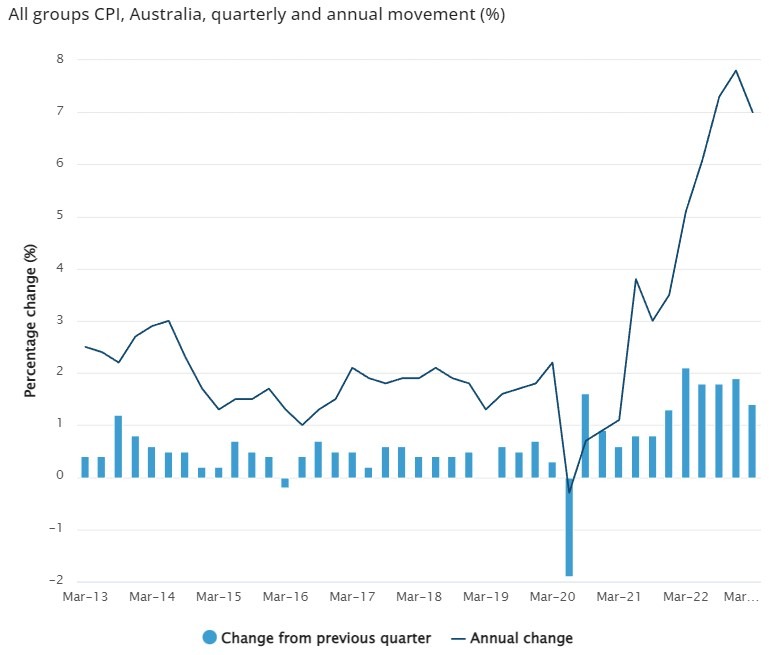

Headline y/y was 7.0%, strongly indicating it has peaked.

Core inflation in Australia is still elevated but looking at the January - March numbers (annualised) this too appears to have peaked.

The case for a May meeting pause from the Reserve Bank of Australia has strengthened on this data today.

AUD/USD is barely changed, circa 0.6621 as I update.