The RBNZ hiked the OCR a larger-than-expected 50bp:

- RBNZ +50bp rate hike (vs. +25bp widely expected)

- New Zealand dollar marked higher on the back of the larger than expected RBNZ rate hike

ANZ in New Zealand, in summary:

- The RBNZ today raised the OCR by 50bp to 5.25% today, defying market and analyst expectations for a smaller 25bp hike.

- We continue to expect a 25bp hike at the May Monetary Policy Statement, and accordingly have revised up our forecast peak for the OCR to 5.50%.

- We’ve also pencilled in three cuts for late 2024.

- The RBNZ has revised up its estimate of the inflationary impact of the cyclone rebuild. It also discussed upside risks to the fiscal outlook. And thirdly, the RBNZ clearly does not want to see any fall in lending rates, and judged a 50bp hike as the best way to prevent that happening.

- The RBNZ and the RBA (who paused yesterday) continue to choose startlingly different paths in the face of very similar inflation numbers.

___

Another New Zealand bank, ASB, say they too are expecting another rate hike at the RBZN May meeting

- +25bp

----

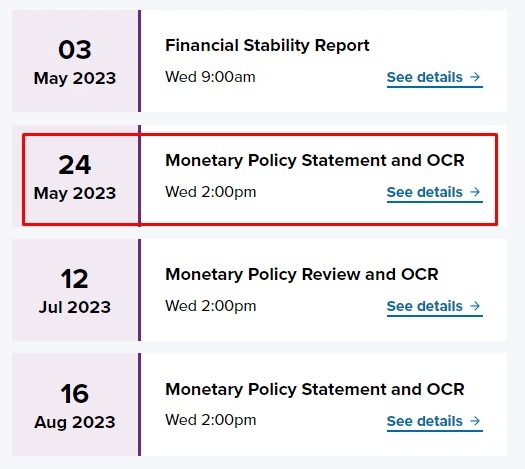

May meeting is the 24th: