An ANZ research note issued Thursday following ANZ's sanguine view of the jobs report:

ANZ say they revising their call for Reserve Bank of Australia rate hikes ahead. Main points summary from their report:

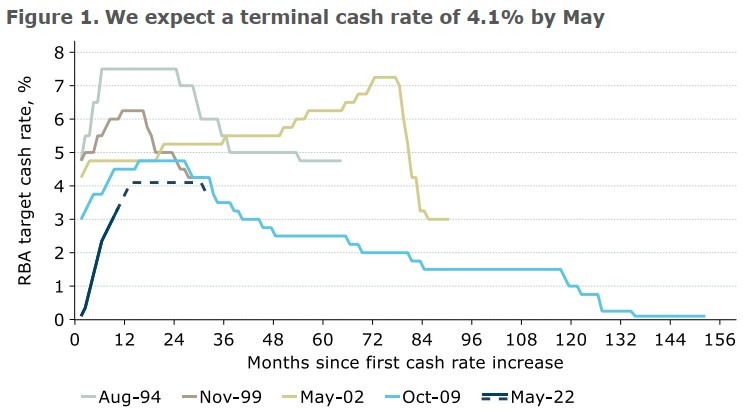

• We now have the RBA cash rate target peaking at 4.1% in May 2023, up 25bp from our previous peak of 3.85%.

• Nearly 70% of mortgage debt has already been impacted by higher variable rates, and to date there is little evidence of a material impact on overall spending.

• Persistence in inflation pressures suggests that the cash rate will remain in restrictive territory for some time. We do not expect the RBA to start easing until a 25bp cut in November 2024.

• Given that price pressures are intense and look to remain stronger for longer, we have lifted our 2023 inflation and wage growth forecasts and see the higher cash rate as necessary to return inflation to the top of the target band by late-2024.

• Our revised rate path has the RBA tightening by 25bp in March, April and May.