Reserve Bank of New Zealand announcement due at 0100GT on the 12th

- Also will issue their latest Monetary Policy Statement (MPS)

- Governor Orr press conference fopllows

Snippet from BNZ on what to expect:

- Reserve Bank will obviously have to acknowledge the impacts of the coronavirus

- as well as increasingly adverse weather locally

- But the Bank also needs to take on board the swathe of economic news since its November MPS which has tended to the positive/potentially-inflationary side of the ledger

- weighing everything up, we think the Bank will produce a very similar interest rate track to that of November. This means no rate move on Wednesday and no rate change for some time.

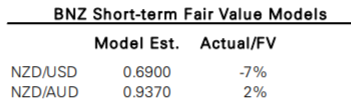

And, on the NZD:

- NZD/USD ... the fall since the spreading coronavirus got international media attention (20 January) to over 3%

- It's not all about the coronavirus though, as the USD has been strong in itself, supported by its yield advantage and recent run of positive economic surprises - a strong US employment report being the latest offering.

- we aren't willing to rule out further downside pressure for the NZD. The longer the economic shutdown in China extends, the greater the impact on NZ's export earnings. Once we get harder evidence of the virus being well under control, then the scene is set for an NZD recovery.

- If not for the coronavirus epidemic, the (RBNZ) would likely be adopting a more hawkish tone, given the recovery in global indicators, upward revisions to NZ GDP, and clear signs of rising domestic inflationary pressure. However, the near-term risk around the coronavirus adds a more cautious overtone to the outlook. We aren't expecting a sustained NZD reaction to the MPS, as we find it hard to think of good reasons why the Statement might surprise the market but at the margin we see the Statement as NZD-supportive.

Earlier: