Reserve Bank of Australia Statement on Monetary Policy for May 2020

Once again the Bank reiterates it will not raise the cash rate ahead of progress being made on its employment and inflation targets

AUD unmoved.

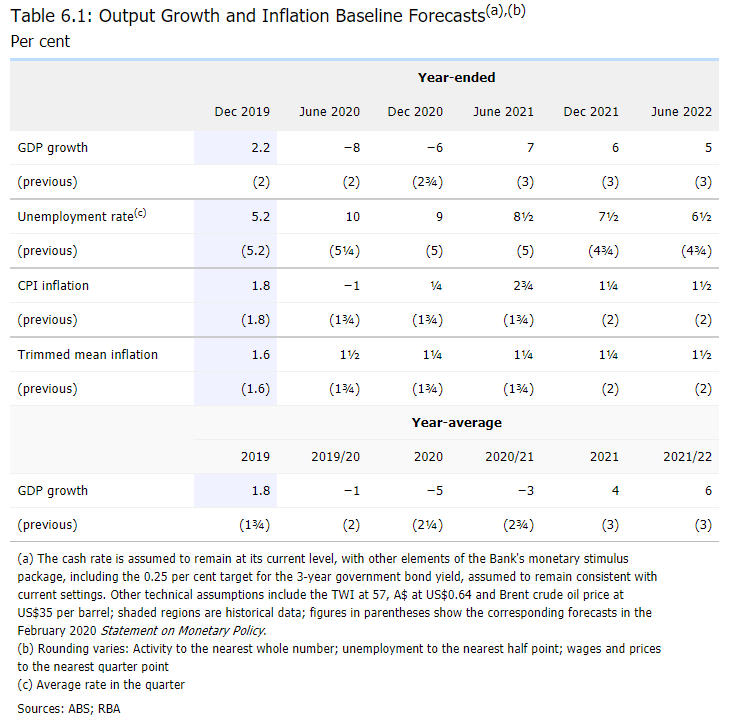

Forecasts:

Headlines via Reuters:

- output is expected to contract significantly over the first half of 2020

- says while the exact size of the contraction is still uncertain, a decline in gdp of around 10 per cent from peak to trough is expected

- the contractions in output in many other economies are likely to be at least as large as that in Australia

- gradual recoveries should follow in the second half of the year

- official unemployment rates, including in Australia, will not capture the full extent of the decline in labour demand

- unemployment rate expected to peak at around 10 per cent

- says total hours worked are likely to contract by around 20 per cent over the first half of 2020

- says market functioning has improved and central bank bond purchases and market operations have been scaled back accordingly

- so far, package of monetary policy measures has been working broadly as expected

- says the Bank is prepared to scale up bond purchases again, if necessary, to achieve the yield target

- says borrowing rates for businesses and households have declined to record low levels

- initial stages of economic recovery could start quite soon, as activities that were previously restricted become possible again, but a full recovery will take time