This from HSBC on the Australian economy, concluding that economic activity has been surprising to the upside.

HSBC have their own proprietary economic 'Surprise Indices'. In a nutshell how they work is that when the index is trending upwards it shows that data released has been better than the market expected (and vice versa).

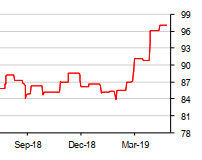

For Australia (ps there is a caveat, I'll get to that):

- The Australia activity surprise index is trending upwards

The caveat is the index does not include inflation data, HSBC says there isn't enough data to include inflation in their index. Fair enough when we only get 4 readings a year from Australia for official CPI.

Recent performance of the index:

---

As to the second part of the headline to this post. What does this mean for the RBA, specifically for the next meeting coming up May 7?

The RBA is looking at the labour market and inflation, from the minutes:

- Members also discussed the scenario where inflation did not move any higher and unemployment trended up, noting that a decrease in the cash rate would likely be appropriate in these circumstances.

I rephrased that point (link here: Does this algo hold the key for an RBA rate cut?)

- a decrease in the cash rate would likely be appropriate (in a) scenario where inflation did not move any higher and unemployment trended up

On inflation - there is no doubt that is weak and has been getting weaker.

On unemployment - its low but there are plenty of opinions that its about to begin heading higher as economic activity weakens. Which, according to the HSBC indicator above, it may well not be weakening.

Is the case strong enough for the RBA to cut on May 7? Let me know in the comments.

Out of interest, HSBC are tipping no cut. More on that call from them here: AUD drop after CPI, forecasts for an imminent RBA rate cut piling in.