The USDJPY pair is trading higher today as the market anticipates the upcoming interest rate decision by the BOJ on Friday. This meeting marks the first for the new Bank of Japan (BOJ) President, Ueda, who has expressed a preference for maintaining the current yield curve control. This stance contributes to a weaker JPY, while the Fed remains concerned about inflation, at least for the time being.

Examining the hourly chart, the price initially dipped during the Asian session but found support against its 200-hour moving average (green line in the chart above). After climbing above the 100-hour moving average, the price tested Friday's high and subsequently retraced below the moving average level.

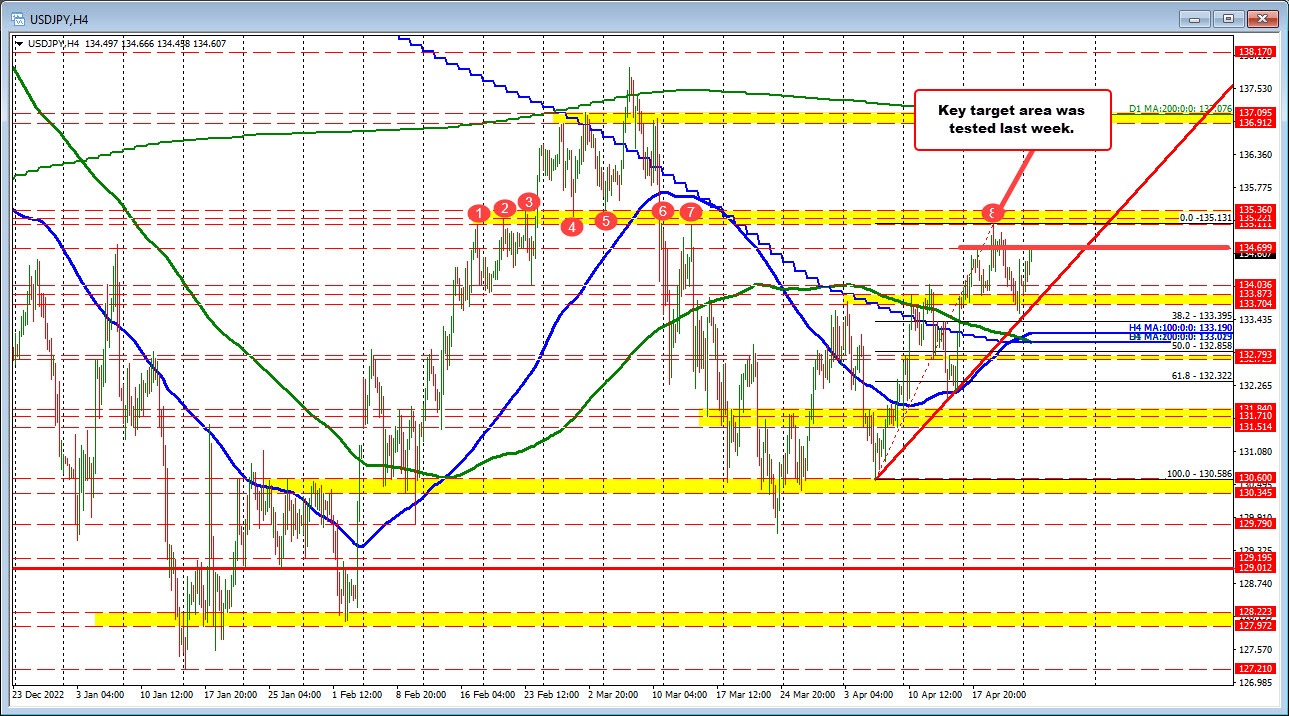

The price has since rebounded and tested last Tuesday's high near 134.70, where sellers entered the market. Recall from last week, choppy trading conditions persisted on Wednesday and Thursday as the price fluctuated around the 134.70 level. Wednesday's high reached the lower boundary of a swing area between 135.111 and 135.36, a critical zone visible in the 4-hour chart below (see red numbered circles). To move higher this week, the price must surpass this swing area.

Taking a broader perspective from the daily chart below, the price broke above its 100-day moving average (blue line, currently at 133.019) on April 14 and has remained above it since. Although last week's up-and-down trading action exhibited little progress, staying above the 100-day moving average in the long term could provide buyers with some optimism. However, a drop below this level this week would damage the bullish bias.

Ultimately, to establish a more bullish outlook, the price must hold above the 100-day moving average and breach the 200-day moving average at 137.076. In March, the price briefly rose above this level before retreating. There have been no closes above the 200-day moving average since December 19, 2022.