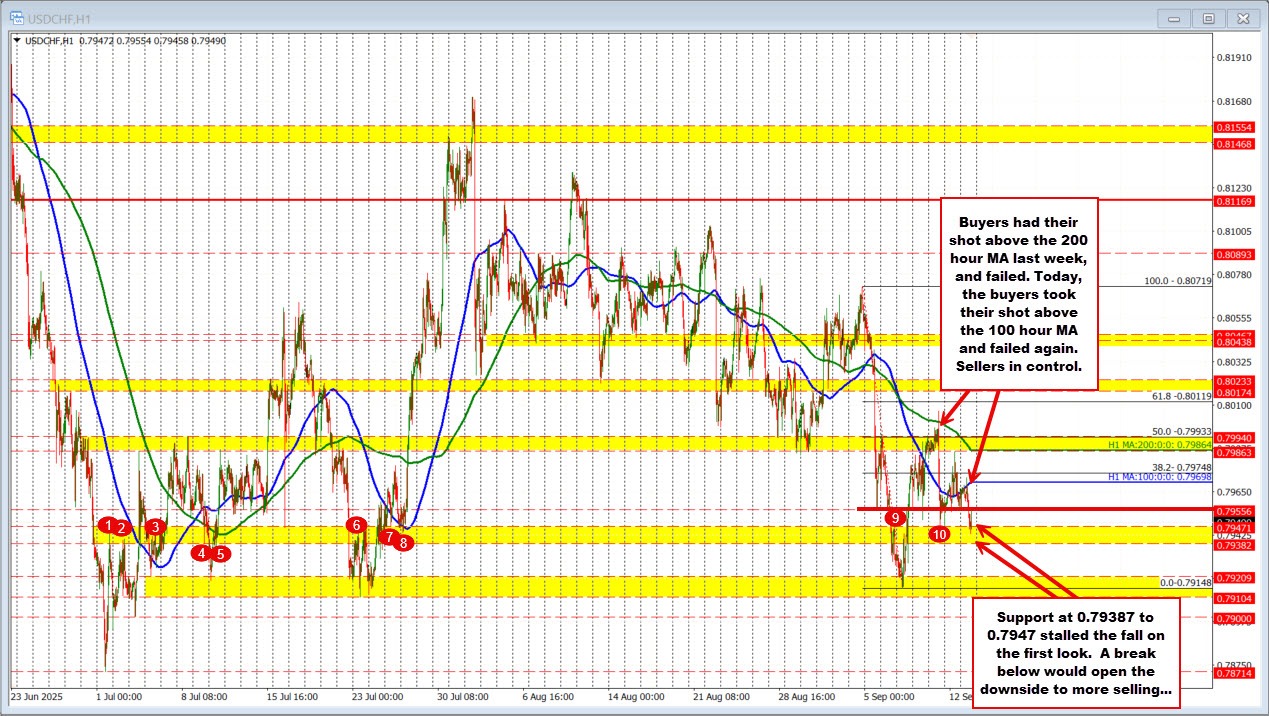

The USDCHF moved lower today, pressured by the release of weaker US Empire manufacturing data. The decline took the pair down to a low of 0.7945, where price action found buyers.

That level is notable because it sits inside a swing area between 0.79382 and 0.79471. Buyers have leaned against this zone before, and once again it provided support, leading to a modest bounce higher.

Going forward, this area remains a critical barometer for both buyers and sellers:

A break below 0.79382 would open the door for further downside, with scope to test 0.7910 to 0.79209.

On the upside, short-term resistance comes in at 0.79556 – a prior swing low from September 5 and close to today’s Asian session low.

A sustained move above 0.79556 would shift the bias higher and put the focus back on the 100-hour moving average at 0.79698.

For now, the market is caught between these well-defined levels, with traders waiting for a clearer break to set the next directional move.