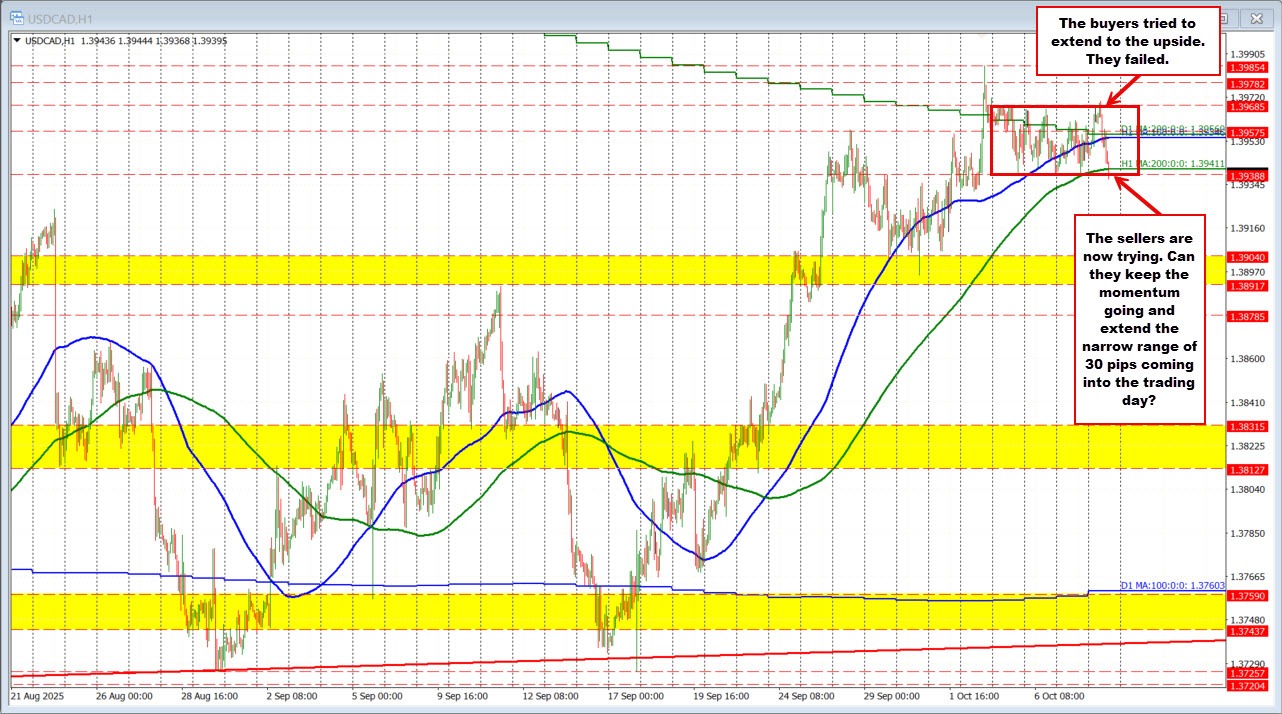

The USDCAD entered the new trading day confined to an unusually tight 30-pip trading range, dating back to the start of Friday’s session. Such a narrow band rarely lasts long, and it puts traders on alert for an eventual breakout with momentum. Overnight, in the late Asian Pacific and early European sessions, buyers attempted to force the issue to the upside, briefly pushing above 1.39685. However, the rally quickly fizzled, stalling at 1.3971 before reversing lower.

That failure opened the door for sellers, who took control by driving the pair back beneath both the 200-day moving average and the 100-hour moving average, converging near 1.3956. The move extended to the bottom of the range at 1.39388, and even slipped fractionally below during the current hourly bar. Still, much like the earlier upside attempt, momentum failed to materialize in full. Sellers are pressing their advantage, but the market has yet to deliver the decisive follow-through they need.

What’s clear is that such a tight range will not persist indefinitely. History shows currency pairs cannot sit in a 30-pip box for long—eventually, something has to give. Whether the break comes to the upside or the downside, traders should be prepared. When momentum finally appears, the move is likely to be sharp, and those positioned correctly will have the chance to capture meaningful extension beyond this period of consolidation.

Anticipate the future. The consolidated price action sets that trade idea up.