The USDCAD had been trading within a 40 trading range going back to last Friday. That range was from 1.3931 to 1.3971. That is just too narrow and wrote about it in this post today.

"....when ranges get this tight, the market is primed for a break. Right now, the 5-day high sits near 1.3971 and the low is anchored at 1.3931. A decisive move beyond either of those boundaries could trigger momentum and a directional run."

The break occurred, and the price has run to a new high for the day and week up to 1.4011.

For buyers, the close risk level is the high from last week at 1.3985. A more conservative risk marker sits just below, at the old high from this week and last Friday near 1.3970. Holding above those keeps the bullish case alive. The buyers are making their push — the question is, how far can it extend?

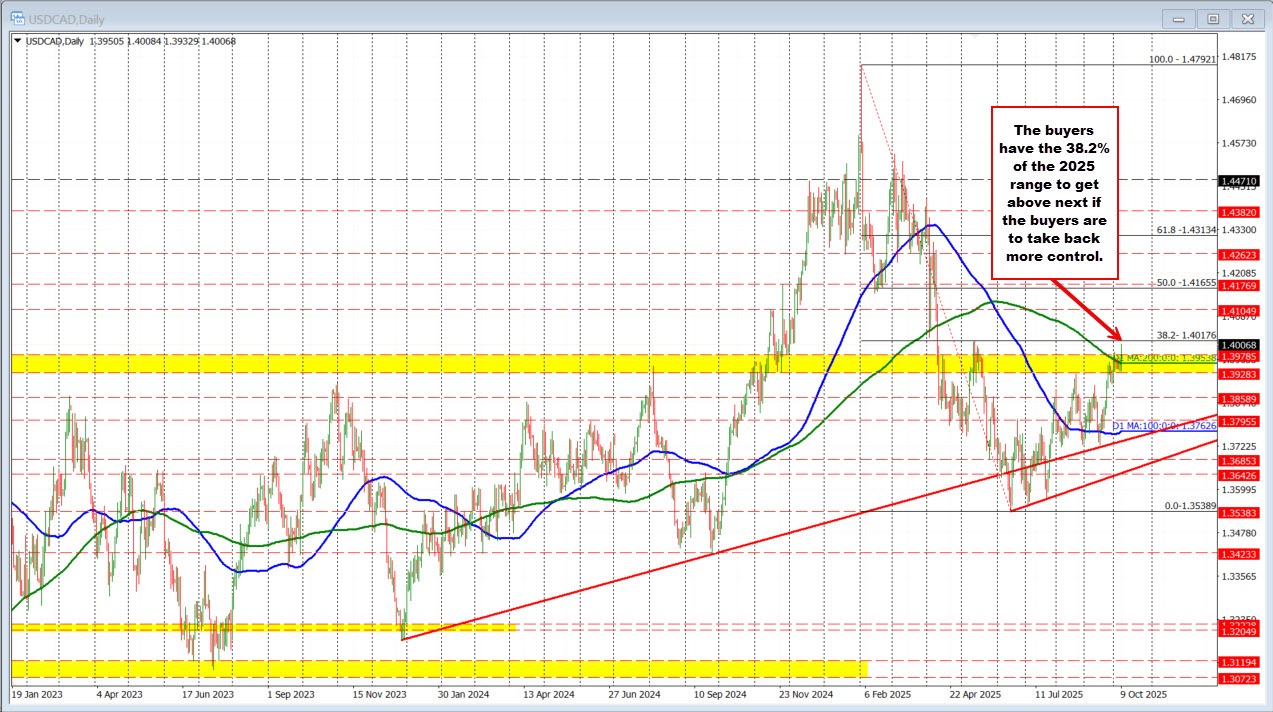

On the daily chart, a key upside target looms at the 38.2% retracement of the 2025 decline, coming in at 1.4018 (see daily chart below). A break above that zone would add conviction to the bullish bias and open the path for further momentum.