The price of the USDCAD is following the dollar lower after the CPI data. Higher oil prices are also continuing to help the loonie. Crude oil is currently up about $0.85 and $82.06. The high price did extend to $82.27 today the highest level since November 10.

Looking at the daily chart of the USDCAD, the pair yesterday moved below the 100 day moving average and 50% retracement of the move up from the October low at 1.2625. The breaking of that dual support level helped to push the price lower into the close.

Today, the momentum to the downside continued with the low price so far reaching 1.25123.

The next major target comes in against its 200 day moving average at 1.2499 (call it 1.2500). There is a swing area between 1.24739 and 1.24914 just below that level.

Sellers need to push below those levels to increase the bearish bias.

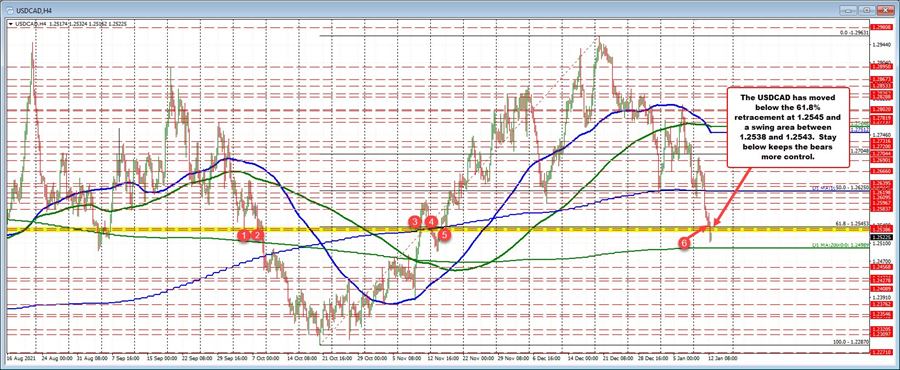

Drilling to the 4 hour chart below, the pair move below the 61.8% retracement of the move up from the October low to the December high. That level comes in at 1.25453. There is also a swing area (see red numbered circles) between 1.3538 and 1.3543. That area up to 1.35453 is now a close intraday risk level. Stay below keeps the bears more control and keeps the fight toward the 200 day moving average in play. Be aware.