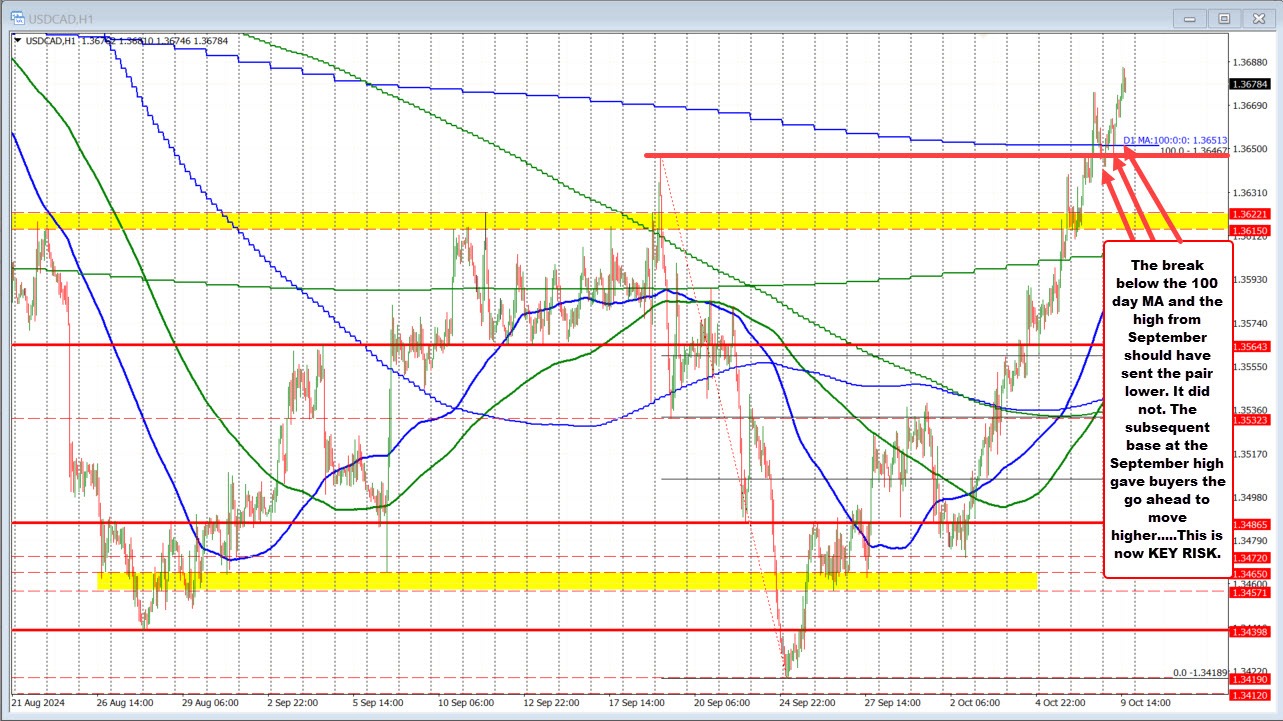

The USDCAD extended above its 100-day moving average yesterday, but by the end of the day was trading back below that he moving average level at 1.36513. In the early Asian session, traders took the price even a lower and back below the high price from September at 1.36467.

Those breaks should have disappointed the buyers and led to more downside momentum. However, buyers it did return, and the next test of the high price from September found dip buyers. That gave the buyers the "go-ahead" to move higher.

This area defined by the high price from September and the 100-day between 1.3646 and 1.3651 is now KEY support. My expectation that another dip below those levels would not be a good thing for the buyers. I would expect buyers to turn to sellers. Absent that, and the buyers can probe higher from the key break back above the 100 day MA level.

Absent that, and the buyers can probe higher.