Dow industrial average leads. NASDAQ lacks

The major US stock indices are trading in positive territory in early session trading. A snapshot of the market currently shows:

- Dow industrial average up 263 points or 0.77% at 34285

- S&P index up 24.7 points or 0.56% at 4538

- NASDAQ index up 53 points or 0.35% at 15308.71

- Russell 2000 is trading up 23 points or 1.1% at 2171.01

The early buying is in contrast to selling to right before the opening in the futures. Go figure.

Zoom shares are not forecasting a return to shut down as the sink to a 52 week low at $195.71. The high price for the year reached $451. Shares are down over 45% on the year

Apple shares are down 2.5% after reports that sales were slowing due to supply constraints. Apple trade near $170 early in this week. It is currently trading at $160.56. Demand is outstripping supply due to the chip shortage.

Crude oil is trading around $64.51 after reaching a low of $62.46. OPEC+ announced that they would continue with the production rises of 400 K per month, but did say they could change that given market conditions (read a slow down from Covid variants).

- Spot gold is trading down $10.43 or -0.59% at $1770.90

- Spot silver is up nine cents or 0.43% $22.39

- Bitcoin is trading at $56,870

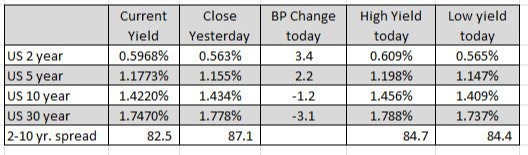

In the US debt market, the yield curve continues to flatten: