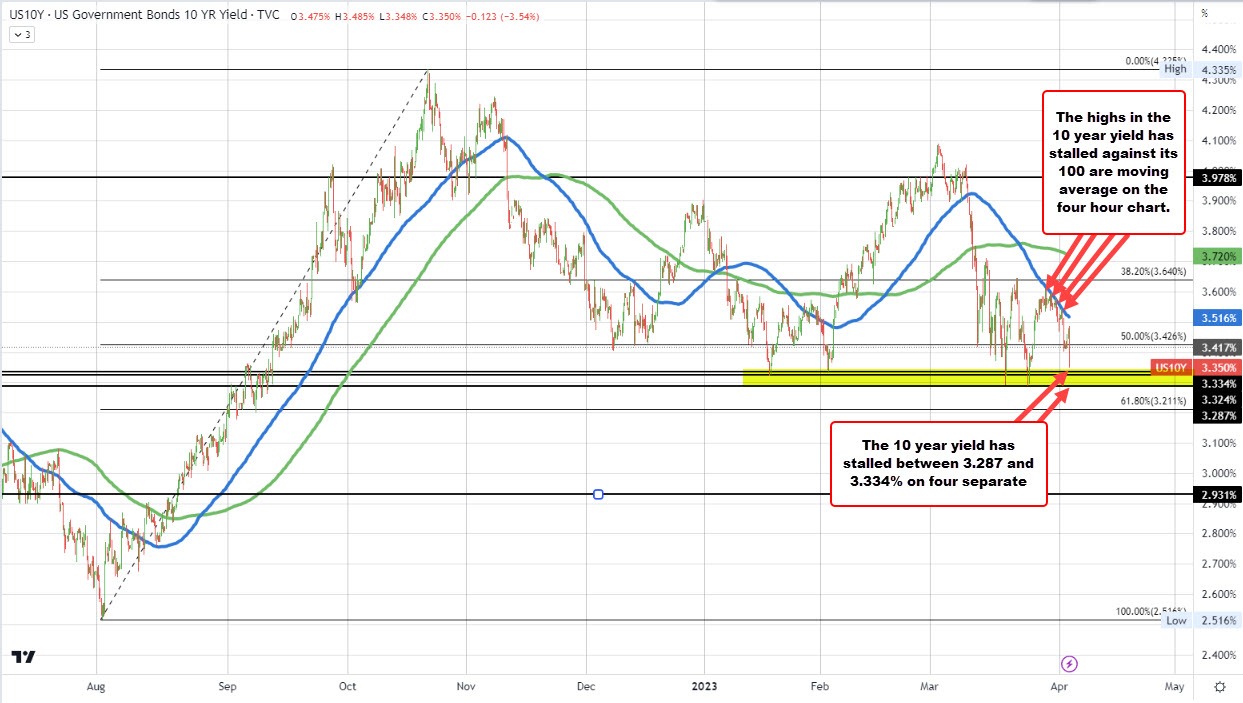

The US 10 year yield is approaching a key support floor coming in between 3.287% and 3.334%. The current yield is trading at 3.352%. A break below that level would take the yield to the lowest level since September 2022, and have traders targeting the 61.8% retracement of the move up from the August 2022 low which comes in at 3.211%.

Of note is that the high yields over the last week or so has stalled against the falling 100 bar moving average on the four hour chart above (blue line). That moving average currently comes in at 3.516% (and moving lower). It would take a move back above that moving average level to tilt bias more to the upside from a technical perspective. Absent that, in the downward bias remains in control.

Meanwhile, the USDJPY is trading to a new session low at 131.514. That has now taken the price below the low swing area on the hourly chart at 131.551 (see earlier post outlining the level HERE).

The USDCHF is testing the low for the year at 0.90586. The low price just reached 0.90618.

US stocks are trading at session laws with the Dow industrial average now down -303 point or -0.90%. The NASDAQ index is down -86.5 points or -0.71%, and the S&P is down -32.4 points are -0.79%.