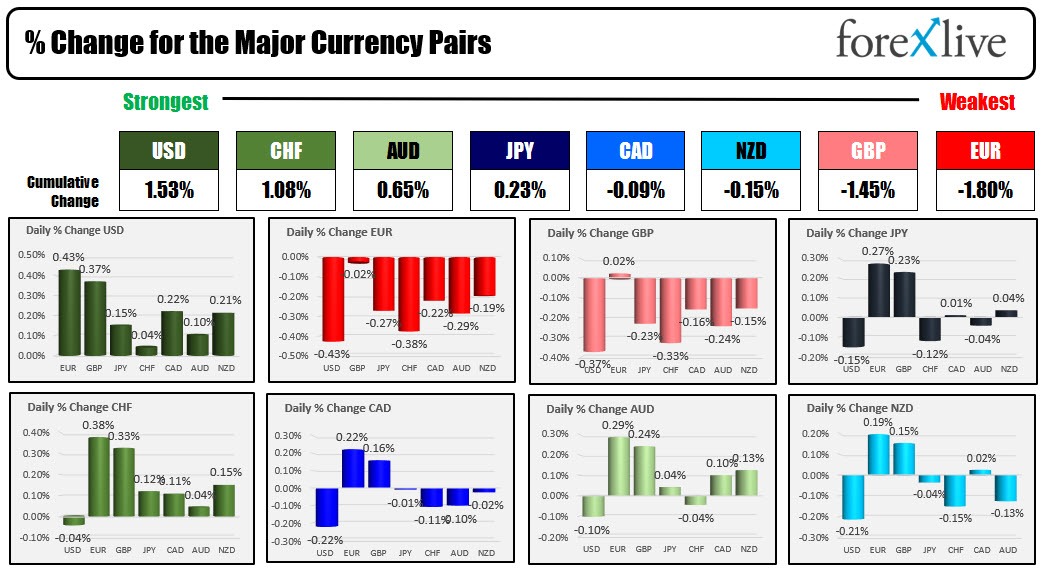

The USD is the strongest and the EUR is the weakest. The dollar index is pushing back toward the highs. China Caixin manufacturing PMI index fell back below the 50 level. The low came in at 49.5 which was worse than the 50.1 expected. China also announced day lockdown in Chengdu. The region is an important industrial center in China. The lockdown has helped contribute to move lower in oil prices.

US stocks are lower but off there lowest levels in premarket trading. US stocks are working on the 5th consecutive day to the downside. The last 2 trading days have had premarket gains and give up those gains closing lower. Today the premarket levels are lower. Will the prices advance and close higher? Nvidia is lower after US restricted sales of its artificial intelligence chips to China.

Today the weekly jobless claims will released with expectations of 250 vs. 243 last week. Nonfarm productivity is expected to be revised to bit higher to -4.3% from -4.6% the recent reported. Higher labor costs are weighing down productivity advances in the US. Labor costs are expected to remain steady at 10.8%. ISM manufacturing will be released at 10 AM along with construction spending.

IN other markets:

- Spot gold is trading down $-9.95 or -0.58% at $1701

- Spot silver is trading down $-0.26 or -1.47% at $17.70

- Crude oil is trading at $88.40 that's down $1.13 on the day

- Bitcoin is trading at $20,080

In the premarket for US stocks, the major indices are lower but off the lowest levels in premarket trading. The major indices on a 4 day losing streak. The futures are implying:

- Dow industrial average down 45.43 points after yesterdays -280.44 point decline

- S&P index is down -12 points after yesterdays -31.16 point decline

- NASDAQ index is down -64 points after yesterdays -66.93 point decline

In the European equity markets, the major indices are also lower

- German DAX -0.94%

- France's CAC -1.05%

- UK's FTSE 100 -1.17%

- Spain's Ibex -0.63%

- Italy's FTSE MIB -0.8%

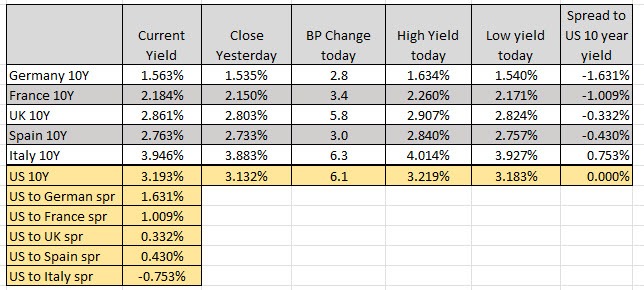

Looking at the US debt market, yields are trading mixed:

- 2 year yield 3.473%, -2.2 basis points

- 5 year yield 3.335%, -2.1 basis point

- 10 year yields 3.195%, unchanged

- 30 year yield 3.314%, +2.0 basis point

Looking at the European debt market, the benchmark 10 year yields are higher: