The USD is lower as the market shifts back toward a cut in December. The expectations is now up to around 80% (it was in the 30%'s last week). The shift came as NY Fed President Williams, Daly and Wallers have shifted to a cut in December. The thought is that the Fed Chair Powell would have likely discussed NY Fed Pres. William's speech and would therefore be shifting the bias that way ahead of the December 10 rate decision (William's is the NY Fed President and as such has more influence than the other Presidents).

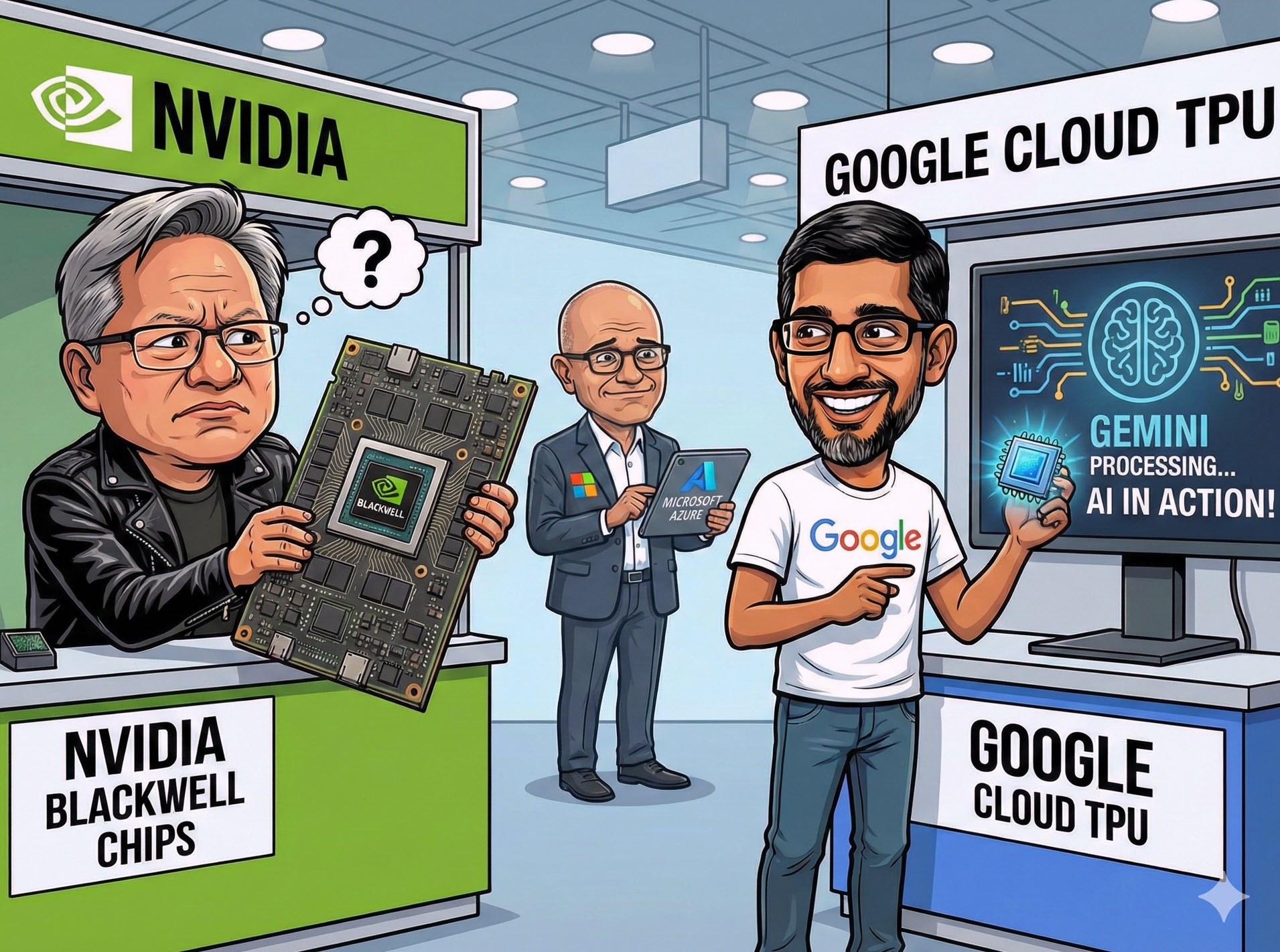

The chip space is in flux after reports that Google and Meta are in talks that could shift major AI workloads away from Nvidia and AMD toward Google’s custom Tensor Processing Units (TPUs), sending Nvidia and AMD shares lower in early trading.

According to The Information, Google has begun pitching TPUs to large customers—including Meta and major financial institutions—with Meta considering a multi-billion-dollar investment to deploy TPUs in its own data centers by 2027 and potentially renting TPU capacity from Google Cloud as soon as next year.

The news fueled concerns that Google’s Gemini AI platform could intensify competition for OpenAI—an important SoftBank investment—driving SoftBank shares down sharply. Adam wrote about this last week after Gemini 3.0 was released "Google proved that you don't need Nvidia and so much more", and it seems it IS doing a good job (see pic below).

While Nvidia and AMD slid on fears of reduced GPU demand, Google and Broadcom—Google’s TPU fabrication partner—traded higher as investors reassessed competitive positioning in a rapidly shifting AI hardware landscape where Nvidia still leads but faces growing pressure from specialized rivals.

- Nvidia shares are trading down -3.63%

- Alphabet shares are trading up +4.44%.

- Microsoft years are trading down -0.87%

- AMD was down -4.5%

- Broadcom is up 3.25%

- Micron is down -1.1%

- Intel is up 0.77%

Looking at the major indices the ups and downs have the indices trading above and below unchanged:

- Dow industrial average was 18 points

- S&P index up 3.38 points

- NASDAQ index -11.85 points

in the US debt market, yields are lower:

- 2-year yield 3.479%, -0.8 basis points.

- 5 year yield 3.589%, -1.5 basis points

- 10 year yield 4.019%, -1.7% basis points

- 30 year yield 4.660%, -1.6 basis points

Crude oil is trading down $1.14 at $57.72 . Gold is trading down to dollars and $0.34 at $4132. Bitcoin is trading down $895 at $87,372