The U.S. dollar is ending the day on a mixed note as traders continue to digest the twin themes of the ongoing government shutdown and today’s softer ADP employment report, which pointed to some cooling in the labor market. U.S. yields moved lower in response, adding to the cautious tone across markets.

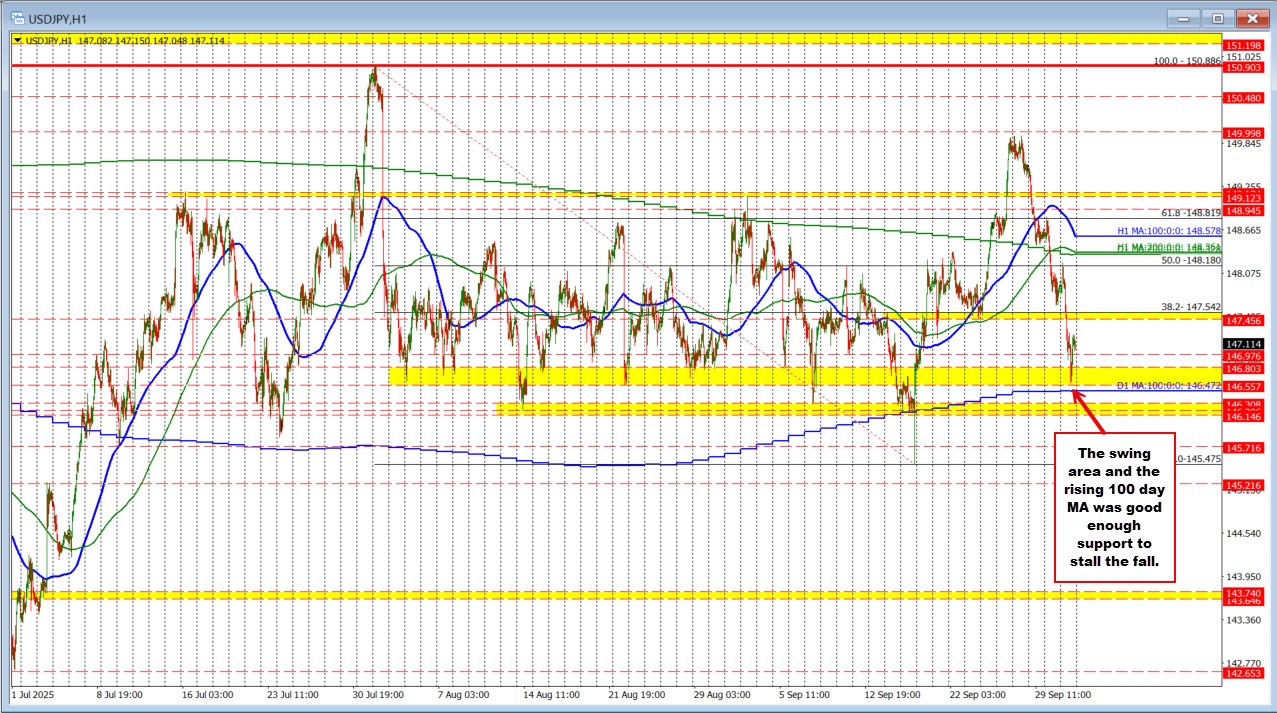

The USDJPY was the day’s biggest mover, falling by -0.52%, marking its fourth consecutive day of declines. The move lower carried the pair into a familiar support zone defined by the swing area between 146.55 and 146.80, with the low of the day reaching 146.58. Just below, the 100-day moving average at 146.47 provided another layer of support and offered dip-buyers a low-risk entry point. It’s worth remembering that on FOMC day, the pair initially broke below the 100-day MA, only to quickly snap back higher — underscoring its importance as a technical pivot.

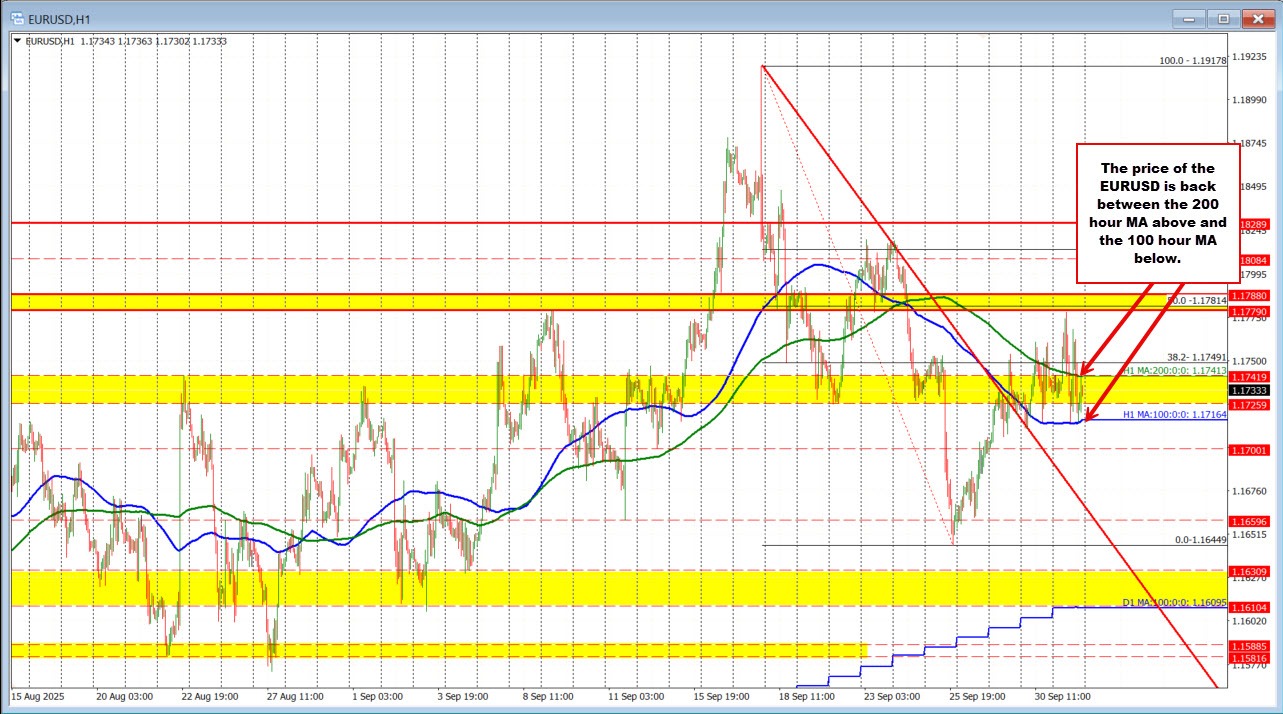

The EURUSD finished the session virtually unchanged at 1.1733. Technically, the pair respected its 100-hour moving average on two separate tests, with the latest occurring in the U.S. session. That bounce carried the price up to the 200-hour moving average at 1.17413 (with the high reaching 1.17412) before sellers reentered and pushed the pair back down. Heading into the close, the price is rotating lower again, holding above 1.1730 but struggling to build momentum.

For the EURUSD, the battle lines are now clear: a sustained move above the 200-hour MA would tilt the bias higher, while a decisive break below the 100-hour MA would reestablish bearish momentum. Until one side wins out, traders will continue to fade moves at the edges and watch for a breakout to define the next directional leg.

The USDCHF once again found willing buyers against its 100-hour moving average at 0.7956 in the early US session, holding that level and bouncing higher. Later in the session, the pair tested the same average for a second time and again attracted support, pushing the price back above to trade near 0.7974.

On the topside, the rally stalled within the familiar swing area between 0.7986 and 0.7994, where sellers stepped in to cap gains. The failure at resistance led to a rotation lower, leaving the pair now caught in a narrow band between the 100-hour MA at 0.7974 and the 200-hour MA at 0.79588.

This range highlights a developing battle zone, with traders leaning against both moving averages for direction. A sustained break outside of this corridor will be needed to tip the balance and define the next trend leg.