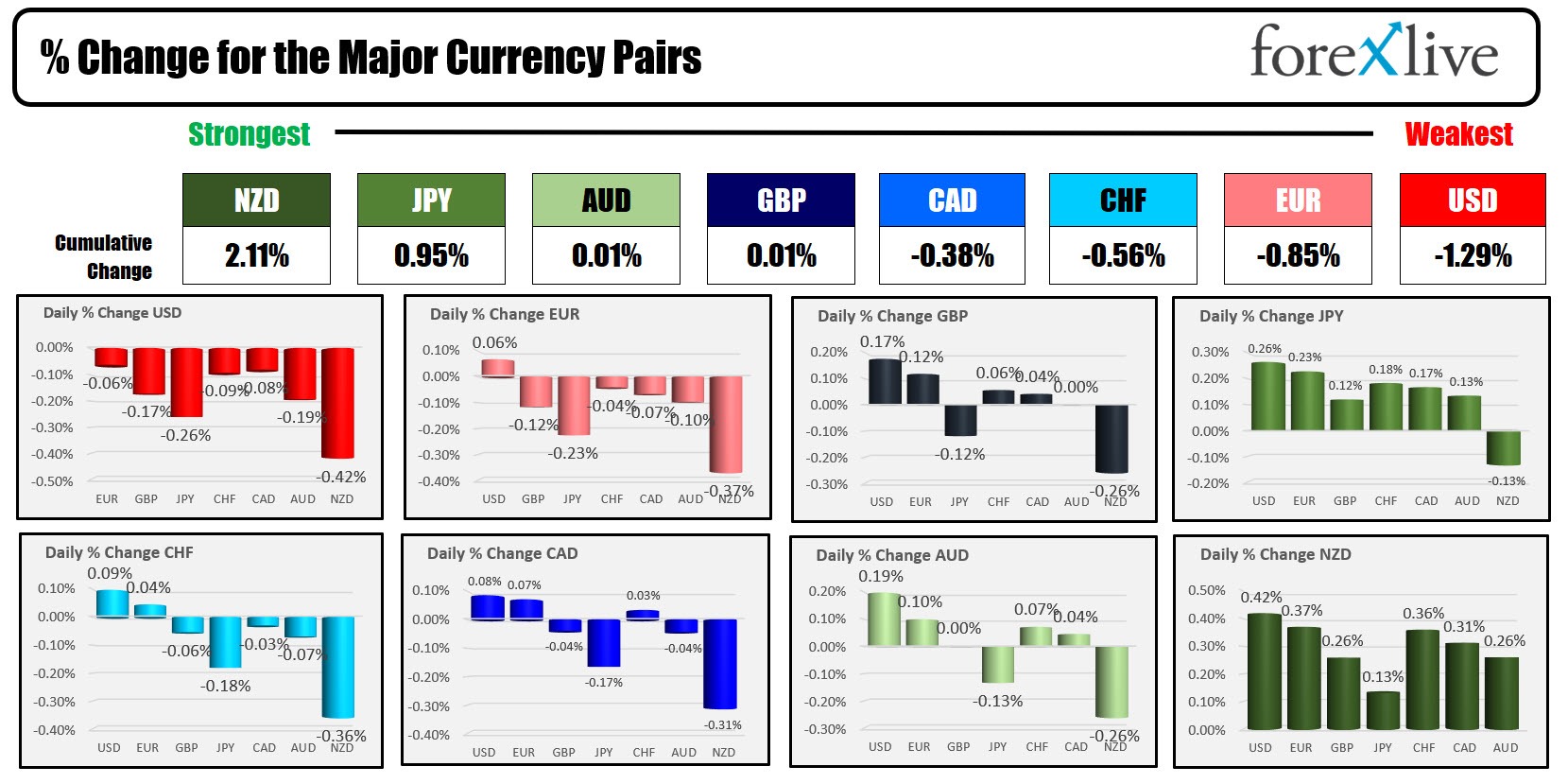

The NZD is the strongest and the USD is the weakest as the NA session begins. The US CPI data will be released at 8:30 AM ET. Adam posted a preview HERE. The headline is expected to rise by 0.2% and the YoY is expected to increase to 3.2% or as Adam points out 3.3%. The rise is due to a -0.1% dropping off from 12 months ago. What is ahead is the next two-month MoM gains from a year ago are at 0.5% and 0.4%. Those figures will be replaced by new numbers which if 0.1% to 0.2% will see a decline in the index by 0.5% to 0.7%. It still is not 2.0% but the trend is more toward that target. Also shelter costs are STILL expected to move lower. That is a wild card to monthly data.

Yesterday Fed's Williams spoke. Some of his comments suggested a slowing of the hype to lower rates:

Economic Balance and Inflation:

- The Fed observes meaningful progress in restoring economic balance.

- Acknowledges that there is still significant work to do to bring inflation back to the 2% target.

- Notes an improvement in the inflation situation.

- Forecasts inflation ebbing to 2.25% in 2024 and 2% in 2025.

Employment and Economic Growth:

- Positive outlook on the job front, with things looking very good.

- For 2024, expects GDP around 1.25% and unemployment at 4%.

Risk Assessment and Future Outlook:

- Points out that risks to the economy are two-sided.

- Emphasizes that rate decisions will be driven by the totality of data.

- Acknowledges the uncertainty in the outlook, with rate decisions to be made meeting-by-meeting.

Federal Reserve's Monetary Policy Stance:

- Stresses the need for a restrictive policy stance for some time.

- Suggests the Fed can cut rates when confident that inflation is moving back to 2%.

- Reiterates that the Fed’s work to bring inflation back to 2% is not yet complete.

Bitcoin is trading highe after SEC approval of the first exchange-traded ETF that tracks the spot price. Eleven Bitcoin ETFs will begin trading for the first time when the stock market opens at 9:30 AM ET. Stocks are higher in premarket trading with the Nasdaq leading the way for the 4th consecutive day. this week. The Dow is trading above and below unchanged in pre-market trading.

Yields are lower. Oil is higher as tensions in the Red Sea continue to be a problem for shippers. In contrast, the weekly US inventory data showed surprise builds in Oil, gas and distillates as demand moves lower.

A snapshot of the markets as the North American session begins currently shows:

- Crude oil is trading up $1.46 or 2.05% at $72.83. At this time yesterday, the price was at $72.61

- Gold is trading up $8.78 or 0.43% at $2032.89. At this time yesterday, it was trading at $2031.14

- Silver is trading up $0.17 or 0.73% at $23.04. At this time yesterday, it was trading at $22.93

- Bitcoin traded at $47,448. At this time yesterday, the price was trading at $44,399.

In the premarket for US stocks, the major indices are trading next after trading mixed on Tuesday

- Dow Industrial Average futures are implying a gain of 14.27 points. Yesterday, the index rose 170.57 points or 0.45%

- S&P futures are implying a rise of 6.8 points. Yesterday, the index rose 26.95 points or 0.57%

- Nasdaq futures are implying a gain of 71 points. Yesterday, the index rose 111.94 points or 0.75%.

In the European equity markets, the major indices are all trading lower:

- German DAX, 0.31%. Yesterday, the index rose 0.01%

- France CAC 0.28%. Yesterday, the index fell 0.01%

- UK FTSE 100 -0.07%. Yesterday, the index fell -0.42%

- Spain's Ibex +0.44%. Yesterday, the index rose 0.07%

- Italy's FTSE MIB 0.20% (delayed by 10 minutes).

Shares in the Asian Pacific markets were mostly lower with Japan's Nikkei leading the way. The made a new 34-year high.

- Japan's Nikkei 225, rose 1.77%

- China's Shanghai composite index , 0.31%

- Hong Kong's Hang Seng index, 1.27%

- Australia S&P/ASX, 0.50%

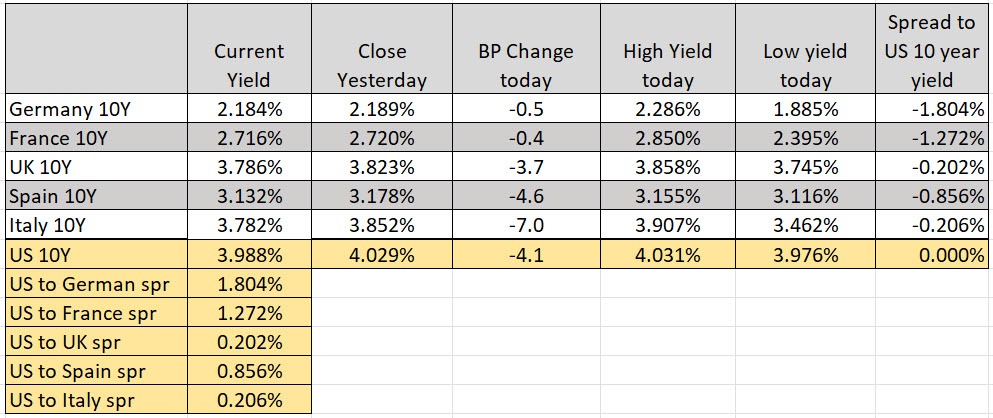

Looking at the US debt market, yields are trading lower after an up-and-down session in yields yesterday:

- 2-year yield 4.337%, -3.4 basis points. Yesterday at this time, the yield was at 4.341%

- 5-year yield 3.933%, -4.8 basis points.. Yesterday at this time, the yield was at 3.945%

- 10-year yield 3.988% -4.2 basis points.. Yesterday at this time, the yield was at 3.996%

- 30-year yield 4.168% -3.2 basis points. Yesterday at this time, the yield was at 4.172%

- The 2-10 year spread is at -34.9 basis points. At this time yesterday, the spread was at -34.5 basis points

- The 2-30 year spread is at -17.0 basis points. At this time yesterday, the spread was at -16.7 basis points

In the European debt market, the benchmark 10-year yields are lower: