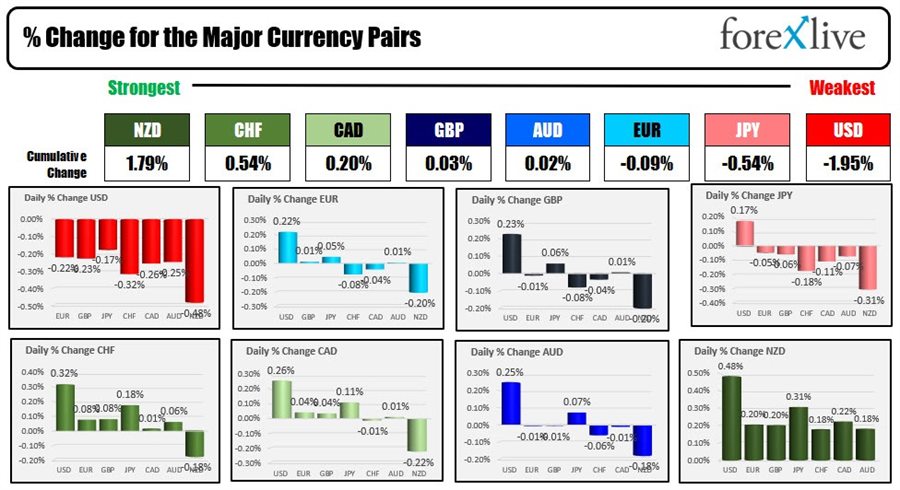

The NZD is the strongest and the USD is continuing its of to the downside and is the weakest of the major currencies at the start of the North American session. The US dollar was a runaway weakest currency yesterday. The EURUSD finally broke out of its up and down trading range above 1.1385. The currency pairs currently trading at 1.1463 to start the New York session.

Today, Lael Brainard will give testimony to the Senate Banking Committee during her nomination process has FOMC Vice chair. Her views on balance sheet will be monitored closely.

Yesterday CPI rose by 7% year on year (highest level since 1982). Today the US PPI released with expectations of input costs rising by 9.8% versus 9.6% last month. The markets shrugged off the higher CPI yesterday. Will it do the same today? The weekly initial unemployment claims will also be released today

US stocks are modestly higher. European shares are mixed. US rates are higher while European benchmark yields are lower. Crude oil is backing off a bit after recent run up. Natural gas prices soared yesterday up over 13%, but are trading down -1.26% today after trading unit higher earlier today.

A snapshot of the other markets currency shows:

- Spot gold down $1.60 or -0.09% at $1824.40

- Spot silver up seven cents or 0.3% at $23.19

- WTI crude oil futures down $0.44 or -0.53% $82.20

- Bitcoin trading modestly lower $43,779

In the premarket for US stocks, the futures are implying higher levels after yesterday's modest gains

- The Dow industrial average is trading up 546.68 points after yesterday's 38.3 point rise. The Dow is up two days in a row

- The S&P is up 1.7 points after yesterday's 13.28 point rise. The S&P is up for two days in a row

- NASDAQ index is up 11 points after yesterday's 34.94 point rise.

In the European equity markets, the major indices are mixed:

- German DAX is unchanged

- France's CAC is down -0.55%

- UK's FTSE 100 is unchanged

- Spain's Ibex is up 0.3%

- Italy's FTSE MIB is up 0.25%

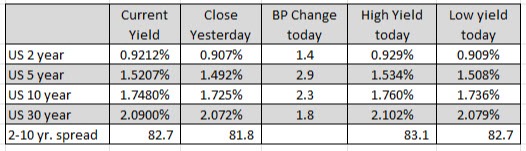

In the US debt market, the US yields are trading higher after a below average 10 year auction yesterday. The US treasury will try again with the auction of $22B of 30 year bonds today at 1 PM. Yields have backed up a bit into that auction at the start of the US session.

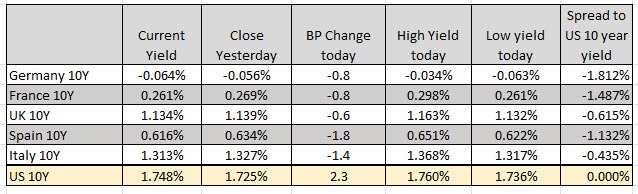

In the European debt market, the 10 year yields are lower today. The spread to the US 10 year yield is a bit wider as well.