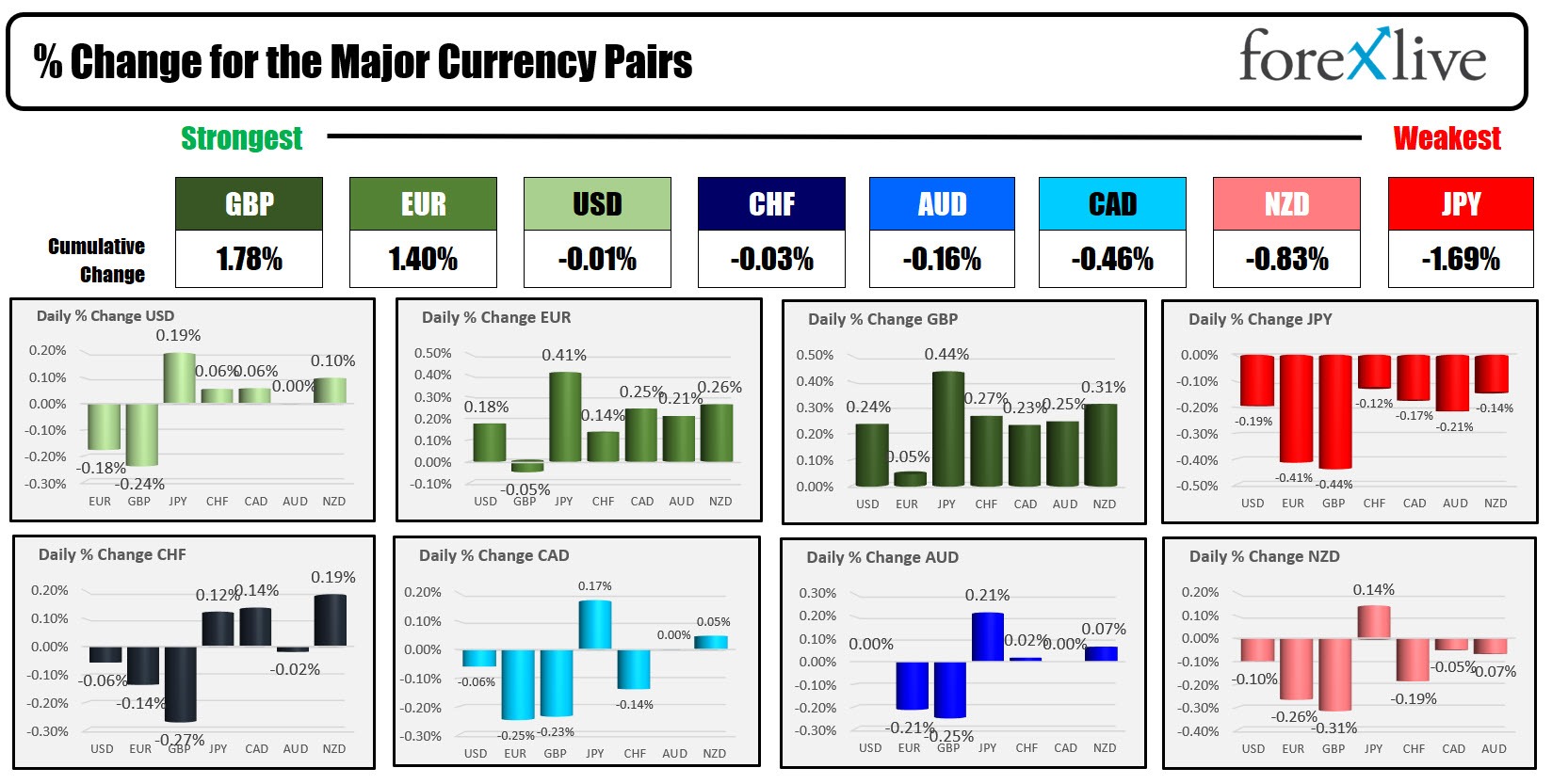

As the North American session begins, the GBP is the strongest and the JPY is the weakest.

In Europe, Swiss CPI came in higher than expected with a gain of 0.6% vs 0.5% expected and 0.2% last month. The CHF is still little changed after rising initially after the data, but has since moved back to the downside. The USDCHF is now trading at new highs for the day (lowest level for the CHF).

The USD is mixed to start the trading week with the USD lower by -0.24% vs the GBP and higher vs the JPY by 0.19% to lead the way in either direction. Apart from the EURUSD, the other pairs are within 0.10% of the prior close. The low to high trading ranges are limited with the EURUSD (21 pips), USDCAD (27 pips), AUDUSD (20 pips), NZDUSD (21 pips) all less than 28 pips (not a lot of action). The narrow range comes after a confined trading week last week too. The EURUSD had only a 70-pip trading range last week. That was the lowest range since November 2019.

The economic calendar to start the trading week is void of any economic releases in the US or Canada. Fed's Harker is scheduled to speak at 11 AM ET which will add some event to the day.

For the trading week, the week will be highlighted by the US jobs report on Friday which economists are currently forecasting a jobs gain or 190K vs 353K last month. The Unemployment rate is expected to remain steady at 3.7% Fed Chair Powell will also testify on Capital Hill on Wednesday and Thursday.. The ECB will announce their latest rate decision on Thursday (unchanged expected) as will the Bank of Canada (on Wednesday also no change is expected). Market participants will be focused on the forward guidance from the respective central bankers. A summary of the key economic release and events is below.

Tuesday, March 5

- 10:00am USD: ISM Services PMI (Expected: 52.9, Previous: 53.4)

- 7:30pm AUD: GDP q/q (Expected: 0.3%, Previous: 0.2%)

Wednesday, March 6

- 8:15am USD: ADP Non-Farm Employment Change (Expected: 145K, Previous: 107K)

- GBP: Annual Budget Release (Tentative)

- 9:45am CAD: BOC Rate Statement and Overnight Rate (Expected: 5.00%, Previous: 5.00%)

- 10:00am USD: Fed Chair Powell Testifies

- 10:00am USD: JOLTS Job Openings (Expected: 8.90M, Previous: 9.03M)

- 10:30am CAD: BOC Press Conference

Thursday, March 7

- 8:15am EUR: Main Refinancing Rate (Expected: 4.50%, Previous: 4.50%) and Monetary Policy Statement

- 8:30am USD: Unemployment Claims (Expected: 212K, Previous: 215K)

- 8:45am EUR: ECB Press Conference

- 10:00am USD: Fed Chair Powell Testifies again.

Friday, March 8

- 8:30am CAD: Employment Change (Expected: 20.0K, Previous: 37.3K) and Unemployment Rate (Expected: 5.8%, Previous: 5.7%)

- 8:30am USD: Average Hourly Earnings m/m (Expected: 0.2%, Previous: 0.3%), Non-Farm Employment Change (Expected: 190K, Previous: 517K), and Unemployment Rate (Expected: 3.4%, Previous: 3.4%).

A snapshot of the markets as the North American session begins currently shows:

- Crude oil is trading at $79.37. Last week the price crude oil rose 4.55% or $3.48

- Gold is trading unchanged at $2082.20. Last week, the price of gold rose 2.32%.

- Silver is trading up 1.4% or 0.06% at $23.14.. Last week silver rose 0.79%.

- Bitcoin currently trades at $65,017. Today the price trades I asked $65,583 the highest level since November 14, 2021. The all-time high level reached $69,000 reached on November 10, 2021

In the premarket, the US stocks the major indices are trading mixed/little changed:

- Dow Industrial Average futures are implying a decline of -106 points. Last week the index fell by -0.11%

- S&P futures are implying a decline of. -5.3 points. Last week the index rose 0.95%

- Nasdaq futures are implying a gain of 7.59 points. Last week the index was 1.74%

In the European equity markets, the major indices are trading mixed:

- German DAX, was 0.01%. Last week the index rose 1.81%.

- France CAC +0.12%. Last week the index fell -0.41%.

- UK FTSE 100, -0.62%. Last week the next fell -0.31%.

- Spain's Ibex, -0.20%. Last week the index fell -0.65%.

- Italy's FTSE MIB, -0.12% (delayed by 10 minutes).

Shares in the Asian Pacific markets were mixed

- Japan's Nikkei 225, +0.50%

- China's Shanghai composite index, +0.41%

- Hong Kong's Hang Seng index, +0.04%

- Australia S&P/ASX, -0.13%

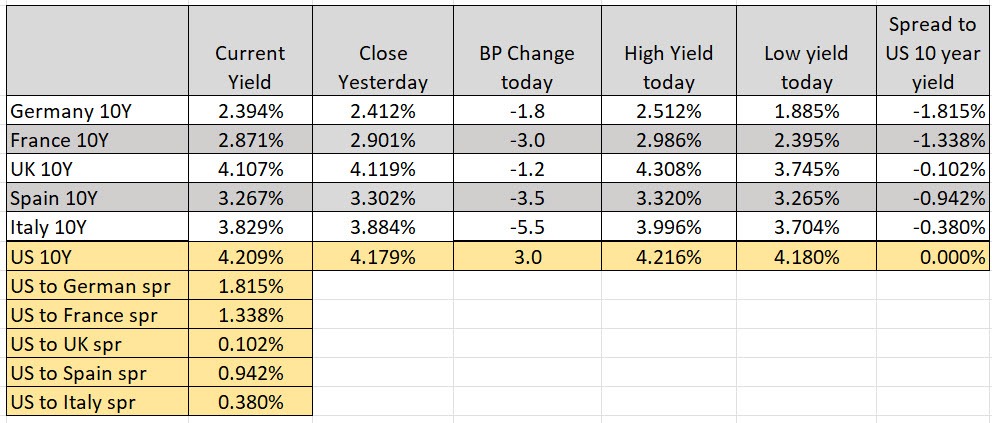

Looking at the US debt market, yields are moving higher:

- 2-year yield 4.558%, +2.5 basis points. Last week the yield fell -15.9 basis points

- 5-year yield 4.183%, +2.4 basis points. Last week the index fell -12.2 basis points.

- 10-year yield 4.205%, +2.3 basis points. Last week the index fell -6.8 basis points.

- 30-year yield 4.357%, +3.1 basis points. Last week the index fell -4.2 basis points.

- The 2-10 year spread is at - -35.3 basis points.

- The 2-30 year spread is at -19.9 basis points.

European benchmark 10-year yields are lower to start the trading week: