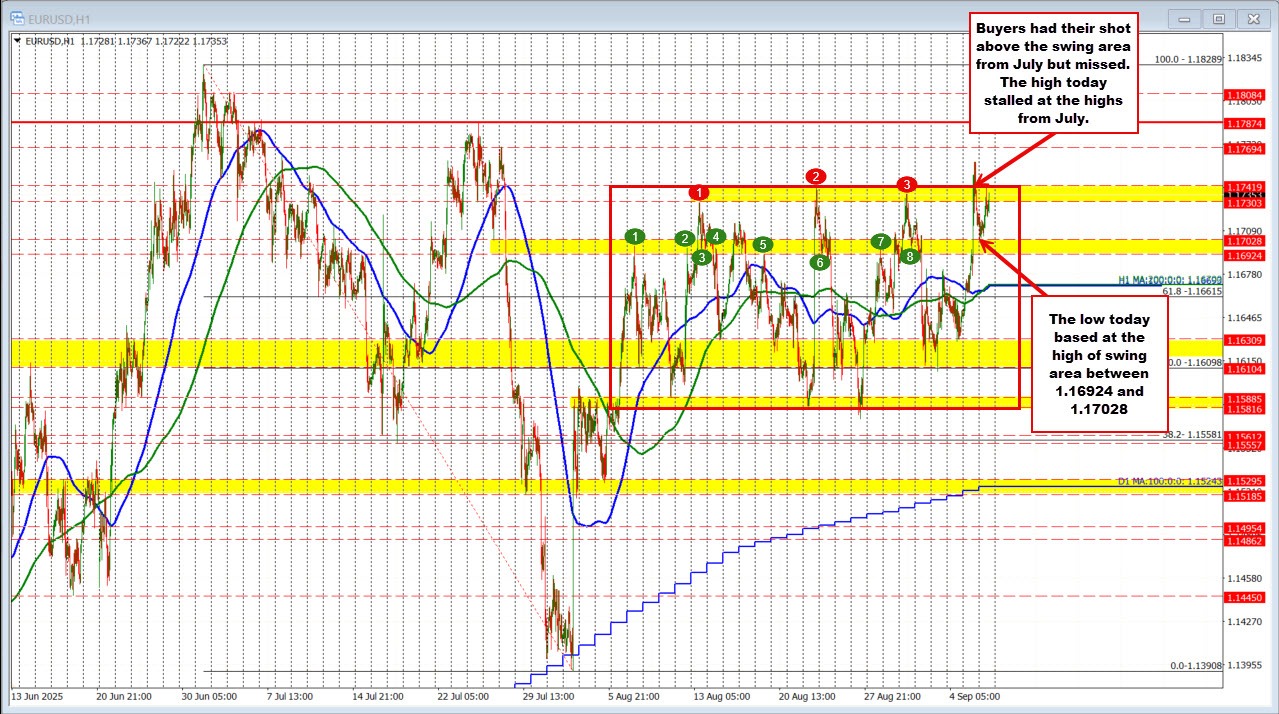

The EURUSD is seeing a modest bounce from Friday’s closing levels. Recall that the pair surged sharply on Friday but gave back some of those gains into the close. That late-session correction dipped to the top of a key swing area between 1.16920 and 1.17028, where buyers stepped in. In early trading today, the low once again held against that support before rotating higher.

On the hourly chart, the European morning rally extended toward another important resistance zone—defined by swing highs from August between 1.1730 and 1.17419. Sellers leaned against the upper edge of that area, with the session high stalling at 1.17421. The pair is now trading back within the zone near 1.17336.

Looking ahead, a break above 1.17419 would open the door to a retest of Friday’s post-employment high at 1.17587. Beyond that, traders will look to the July peaks at 1.1769 and 1.17874, with the yearly high from July 1 at 1.18289 standing as the next major upside target.

Conversely, if sellers continue to defend the July highs, focus shifts back to the lower swing area between 1.1692 and 1.17028. A break below this zone would weaken the near-term bias and turn attention toward the converging 100- and 200-hour moving averages, currently clustered around 1.16698. A move through that level would signal a deeper corrective phase and invite additional downside pressure.