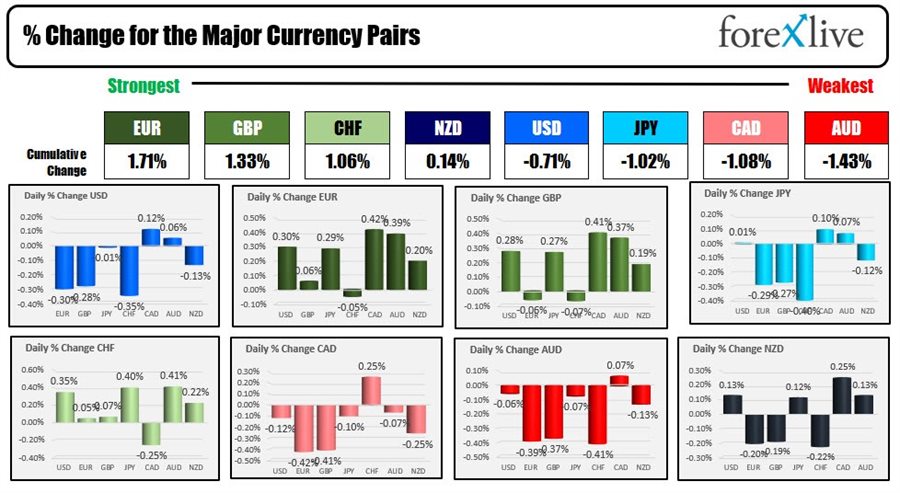

As the North American session begins, the EUR is the strongest and the JPY is the weakest of the major currencies. The USD is weaker with declines vs EUR, GBP, CHF and NZD leading the way lower. The greenback is marginally changed vs the JPY, CAD and AUD.

The FOMC will start their two day meeting today which will culminate with their statement and decision on policy being released at 2 PM ET tomorrow. The expectation are for the Fed to double the taper to $30B per month (from $15B). The Fed is still buying some $105B per month. The market will also pay attention to the dot plot which is expected to show the Fed penciling 2 hikes in 2022. PS On Thursday, the BOE and ECB will announce their rate decisions with expectations of no change.

The US stock market is mixed with the Dow marginally higher. The Nasdaq continues to slump for the 2nd consecutive day. The S&P is marginally lower as well in the morning snapshot. Pfizer announced that a covid pill result appears to be effective against the omicron variant. Their shares are down -0.40% despite the news (was up around 2.5% yesterday though). Apple shares drive toward 3T market capitalization at $182.86 (price at $177.45, up 0.85% in pre-market trading).

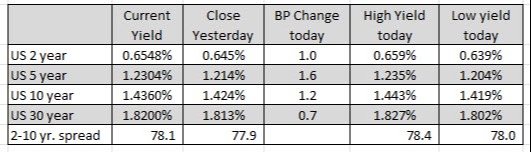

US yields are higher ahead of the producer price index data to be released at 8:30 AM ET. The YoY is expected to rise further to 9.2% (0.5% est MoM) vs 8.6% last month (ex food and energy at 7.2% (0.4% est MoM) vs 6.8% last month).

In other markets, the snapshot currently shows:

- Spot gold is trading down -$1.70 or -0.09% at $1783.90

- Spot silver is trading down $0.18 -0.82% at $22.13

- WTI crude oil futures are trading at $71.23 which is down marginally from the settle price of $71.29 yesterday

- Bitcoin is trading at $47,616. Near the 5 PM close yesterday the price is trading at $46,507.

In the premarket for US stocks, the morning snapshot a showing that the futures are implying:

- Dow industrial average -3 points after yesterday's -320.04 point decline

- NASDAQ index -72 points after yesterday's -217.32 point decline

- S&P index -9.6 points after yesterday's minus 43.03 point decline

in the European equity markets, the major indices are trading higher:

- German DAX unchanged

- France's CAC unchanged

- UK's FTSE 100 +0.4%

- Spain's Ibex +0.8%

- Italy's FTSE MIB +0.45%

In the US debt market, yields are marginally higher with the five year leading the way with a 1.6 basis point rise.

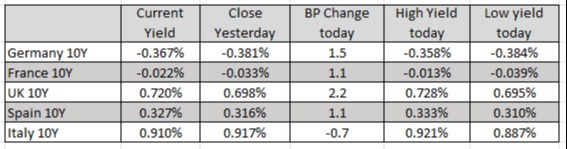

In the European debt market, the benchmark 10 year yields are also trading higher: