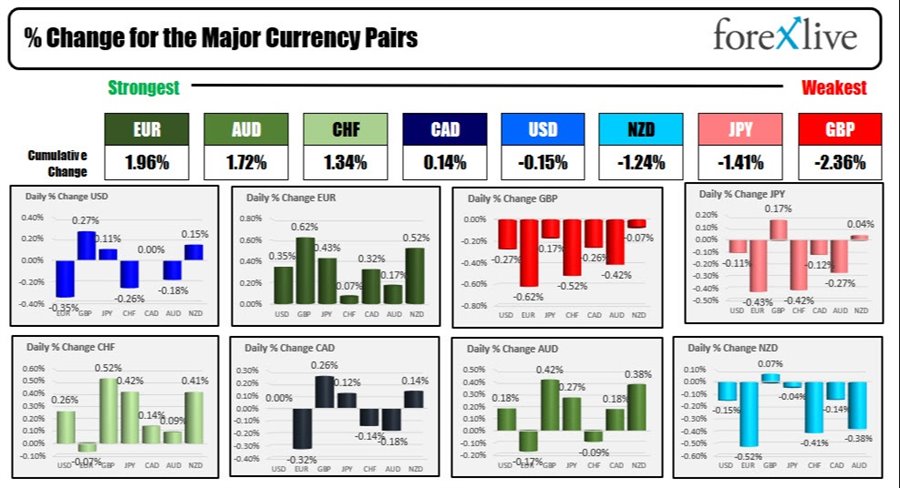

As the North American session begins, the EUR is the strongest and the GBP is the weakest. The USD is mixed with little changes verse the JPY, CAD, NZD (all within 0.15% of the closing level from yesterday).

The GBP has slumped on concerns of another shut down due to omicron. However, there has been some mixed news on the variant. So. Africa confirmed that the effectiveness of the current vaccines are partly reduced. Meanwhile Pfizer is now reporting that they are seeing neutralization of omicron from three vaccine doses, and two doses still offer significant protection.

US stocks have moved higher off of the Pfizer news. The NASDAQ index is now up near 43 points (as per the futures). Yesterday that index and the S&P index had the best day since March with gains of 3% and 2% respectively. The S&P closed within 1.2% of the all-time high.

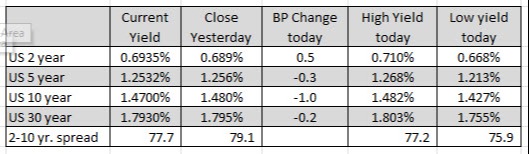

US rates are modestly lower/mixed. The two year yield reached a high of 0.71% today. That is the highest level since early March 2020. The Fed hike probability is up to 75% in June and 83% July. There is now a 65% chance for a hike in September, and a 60% chance for a December hike.

The Bank of Canada will announce their rate hike projections at 10 AM ET/1400 GMT today. There is no change expected today.

The US JOLTS job openings four October are expected 10.45M vs 10.44M last month (at 10 AM ET). The trends are important but the data is old.

The weekly energy inventory data will be released at 10:30 AM ET. Crude oil inventories are expected to show:

- Oil -1705

- Distillates +1571

- Gasoline +1798K

The private data showed a -3.089M drawdown. Crude oil is trading mid range for the day at $72.14.

In other markets, the snapshot currently shows:

- Spot gold is up $1.50 or 0.09% at $1785.50

- Spot silver is down five cents or -0.23% at $22.41

- WTI crude oil futures are trading at $72.11 up slightly from the civil price of $72.05 yesterday. The price is trading mid range with a high of $72.76 and a low of $70.93.

- Bitcoin is trading back below the 50,000 level at $49,090. Near the 5 PM close from the North American session, the price was trading at $50,695

in the premarket for US stocks, the major indices are higher off of the Pfizer news (but off their highest levels as well):

- Dow Jones +49 points after yesterday's 492.4 point rise

- NASDAQ index +37 points after yesterday's 461.76 point surge

- S&P index +8 points after yesterday's 95.08 point rise

In the European equity markets, the major indices are mostly lower after two strong days to start the week:

- German DAX, -0.45%

- France's CAC, -0.2%

- UK's FTSE 100, +0.13%

- Spain's Ibex, -0.5%

- Italy's FTSE MIB -0.6%

In the US debt market, the two year yield is up 0.5 basis points but the other yields are down modestly with the 10 year yield down -1.0 basis points in the morning snapshot:

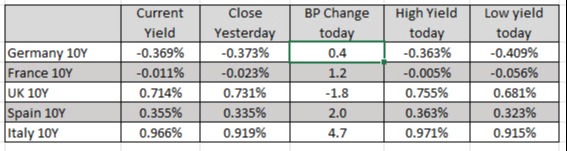

European yields are mostly higher with the exception of the UK 10 year down -1.8 basis points on shutdown fears: