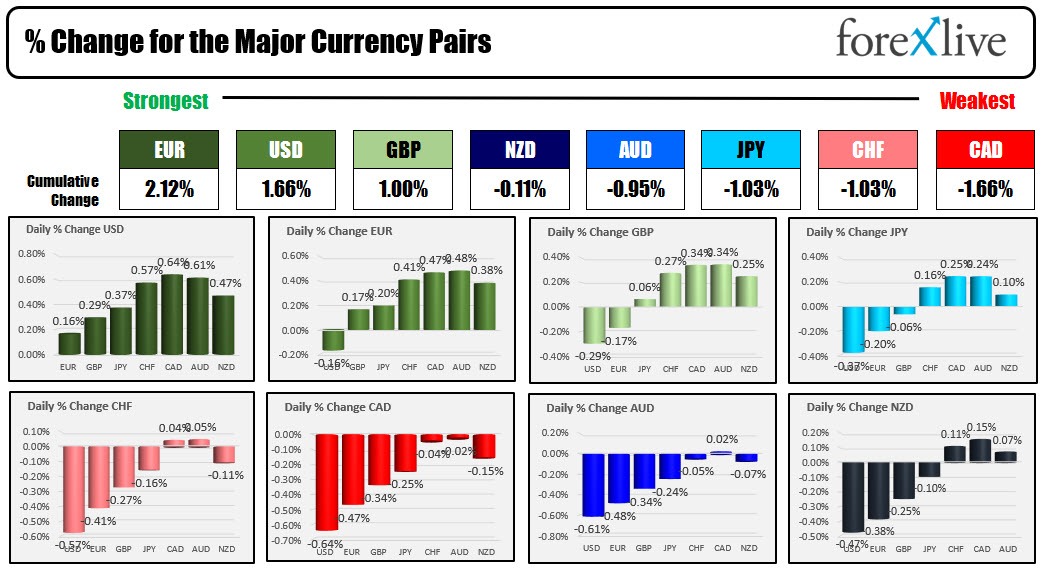

The EUR is the strongest and the CAD is the weakest in what has been an up and down (or down and up) day for most currency pairs. The USD is right behind the EUR and mostly stronger as North Amercan session enter for the day. The GBP is also higher mostly and off the lowest levels on the day. German inflation came in higher at 10% this month - which is higher than the 9.4% expected. The MOM rose 1.9%. Later this morning the US Final GDP for the 2Q will be released along with the timely weekly initial claims. Next week the US jobs report will be released.

The yuan did move a bit higher today and off the boil after reaching the highest level since 2008 yesterday.

US stocks are trading lower after the bounce back day (in all markets) saw the US stock indices rise by 1.9% to 2.10%. US yields are also moving back the other way (higher) after sharp declines yesterday.

European stocks are also lower and their yields are also back higher after falling yesterday. The worlds problems are not solved in a day when there is continued anxiety from inflation, slower global growth, Russian anxiety (sabotaging pipelines?), central bank policy fighting with fiscal policy (and monetary policy being reverved - buying bonds in the UK - just when they were to start selling bonds)...

Fed's Bullard and Mester will be speaking (Mester is speaking with CNBC Liesman as I type). She says US must get US inflation down. She sees service inflation being much more persistent. Labor market demand still is outpacing supply. She says we are still not in restrictive territory on the fund's rate.

A snapshot of the markets is showing:

- Spot gold is trading down $8.70 or -0.52% at $1651

- spot silver is trading down $0.22 or -1.12% at $18.66

- crude oil is trading at a $2.20 that's up 0.04% on the day

- the price of bitcoin is trading at $19,423 that's up marginally from yesterday's closing level

in the premarket for US stocks, the major indices are trading lower:

- Dow industrial average -237 points after yesterday's 548.75 point rise

- S&P index -39 points after yesterday's 71.75 point rise

- NASDAQ index -150 points after yesterday's 232.13 point rise

In the European equity markets:

- German Dax -1.48%

- Frances CAC -1.32%

- UK's FTSE 100 -1.1%

- Spain's Ibex -1.53%

- Italy's footsie MIB -1.5%

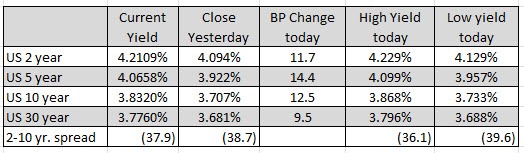

in the US debt market, yields are higher across the board. Yesterday the two year yield fell by -19 basis points while the 10 year yield fell by -24.5 basis points:

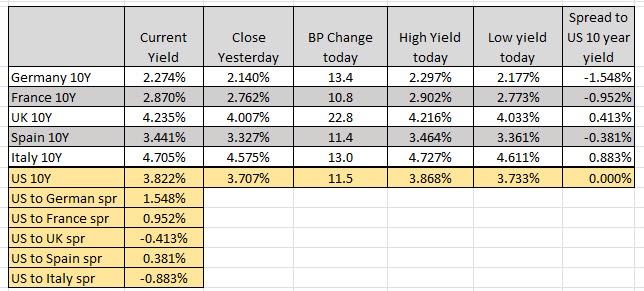

in the European debt market, yields are also back higher with the UK 10 year yield up 22.8 basis points. It tumbled by over 40 basis point yesterday.