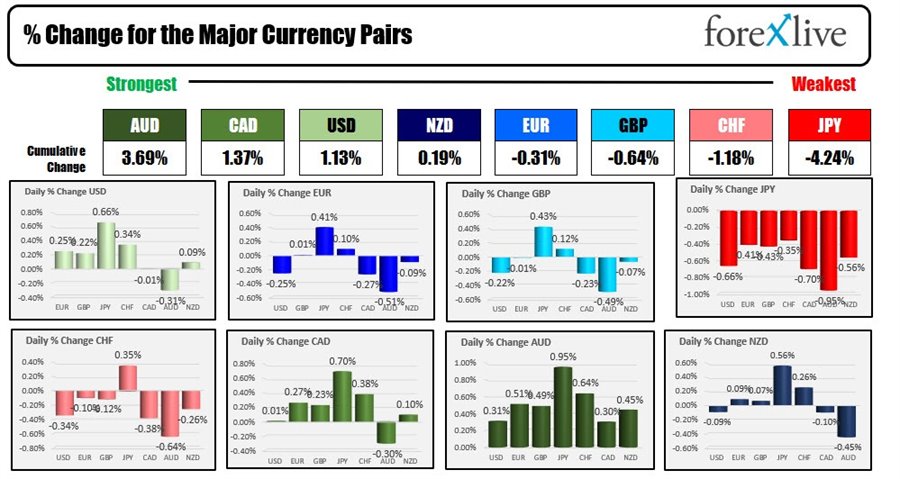

The AUD is the strongest and the JPY is the weakest as the North American session begins. The USD mostly stronger to start the day. US rates are higher helping to tell the USDJPY . BOJ Kuroda said earlier this week, that he will continue to keep the foot on the stimulus gas pedal, while calls in the US continue to be for higher rates to cut off inflation. The USDJPY came off the boil after peaking on May 9th, but has pushed higher over the first three days of the week and approaches a swing high area between 129.63 and 129.787.

US stocks are also higher in pre-market trading.

In Europe, the PMI data grew at its lowest rate in around a year and a half (EU lowest since December 2020). In the UK, it's PMI fell to the lowest level since March 2021. EU flash CPI inflation spiked to 8.1% from 7.5% in the prior month yesterday. The core measure rose to 3.8% from 3.5%. The data is prompting some ECB officials to call for a 50 basis point hike once again. The EURUSD traded mostly between its 100 hour moving average above at 1.07347 and 200 hour moving average below at 1.06966 in trading today and awaiting a greater shove in either direction from traders to get it out of the neutral area.

The US mortgage demand fell to the lowest level since before the Covid today. The rest of the economic calendar is full with the JOLTs job openings numbers (11.29 million vs. 11.55 million last month) released at 10 AM ET, along with construction spending (+0.7% vs. 0.1% last month), and the ISM manufacturing PMI index (54.4 vs. 55.4 last month). Also 10 AM, the Bank of Canada is expected to raise rates by 50 basis points to 1.5% from 1.0%. Canada manufacturing PMI will be released before that at 9:30 AM ET.

The big economic release will come on Friday with the US jobs report with expectations of nonfarm payroll rising by 325K vs. 428K last month. The unemployment rate is expected to dip to 3.5% from 3.6%.

Later this afternoon the US beige book will be released at 2 PM ET. FOMC's Williams and Bullard are both expected to speak as well today. Atlanta Fed Pres. Raphael Bostic walked back his comment of a September pause in rates overnight. Recall, his comments helped stocks to rebound last week after 7 weeks of declines for the S&P and Nasdaq and 8 weeks of declines for the Dow. The shortened week got off to a weak start yesterday with all three major indices lower. As mentioned the US stocks are higher and erasing some/most of the declines.

A snapshot of the markets are showing:

- Spot gold is trading down $-5.23 or -0.30% at $1831.25

- Spot silver is down up $0.07 or 0.33% $21.59

- WTI crude oil is trading at up $0.89 at $115.53

- Bitcoinis trading at $31,566 down $-100 or -0.31%

In the premarket for US stocks, the futures markets are implying a modestly higher opening

- Dow is trading up +158 points after yesterdays -222.84 decline

- S&P index is +12.25 points after yesterdays -26.07 point decline

- NASDAQ index is +36 points after yesterdays -49.74 point decline

In Europe: the major indices are trading mixed as North American traders enter for the day

- German DAX is up 0.27%

- France's CAC up 0.12%

- UK's FTSE 100 down -0.18%

- Spain's Ibex is -0.41%

- Italy's FTSE MIB is trading unchanged

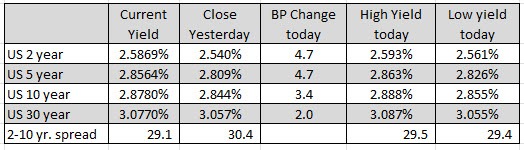

The US debt market this morning, yields are trading higher with the yield curve modestly lower:

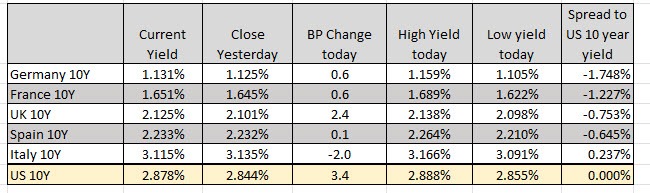

In the European debt market the benchmark 10 year yields are mostly higher (exception is the Italian 10 year yield).