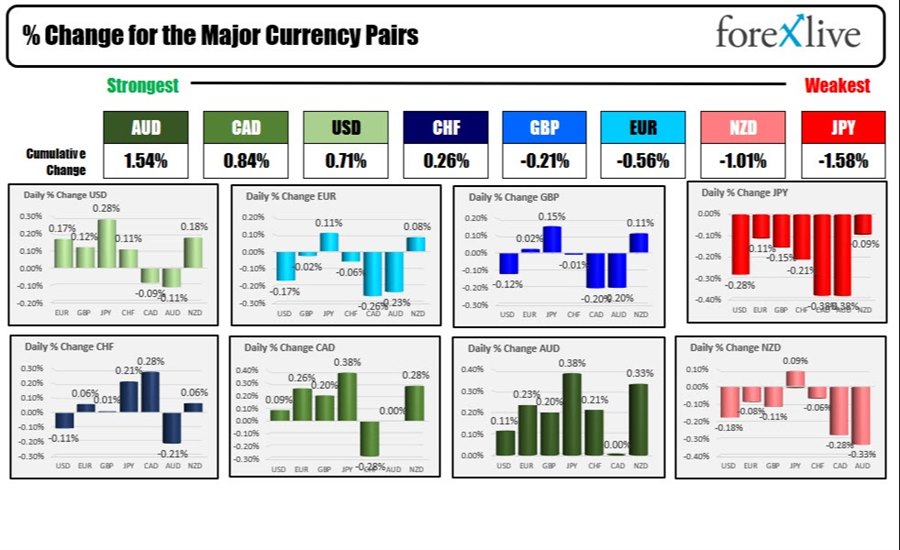

The AUD is the strongest and the JPY is the weakest ahead of the US CPI data at 8:30 AM ET. The USD is mostly higher ahead of the data.

The CPI YoY is expected to rise to 6.8% (fastest since 1982 - 0.7% MoM) although there are rumblings of a 7% headline number too. The core measure is expected to come in at 4.9%. The Fed's Powell (et. al) have changed their tune toward fighting inflation now (no longer "transitory") and will likely look to taper at a faster $30B vs $15B currently when they meet again next Wednesday. The Fed is expected to hike rates between 2-3 times in 2022 now.

The Michigan consumer sentiment will also be released today (10 AM ET) with expectations for the preliminary) release at 67.9 verse 67.4 last month.

US stocks are higher in premarket trading. Bond yields are also higher ahead of the data. Crude oil is up from the settle price of $70.94 yesterday. Gold is near unchanged. Bitcoin is higher but holding below the natural resistance at $50,000.

In other markets the morning snapshot currently shows

- Spot gold is trading down $1.80 or -0.10% at $1772.30.

- Spot silver is down eight cents or -0.41% at $21.84

- WTI crude oil futures are trading at $71.73 up from the settle price of $70.94 yesterday

- Bitcoin is trading at $49,015.92. The high price reached $49,243.23. The 100 hour moving average is currently at $49,703. Stay below is more bearish.

In the premarket for US stocks, the major indices are trading modestly higher:

- Dow industrial average is up 45 points after yesterday's unchanged day (-0.06 points)

- S&P index is trading up eight points after yesterday's -33.78 point decline

- NASDAQ index is trading up seven points after yesterday's -269.62 point plunge

In the European equity markets, the major indices are mostly near unchanged levels:

- German DAX, unchanged

- France's CAC -0.1%

- UK's FTSE 100 unchanged

- Spain's Ibex -0.35%

- Italy's FTSE MIB unchanged

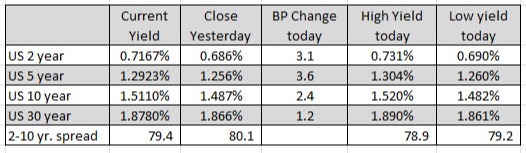

The US debt market, the US yields are higher with the short rent outpacing the longer end. The two year yield is up 3.1 basis points while the 30 year is up 1.2 basis points:

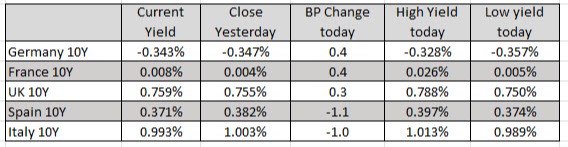

In the European debt market the benchmark 10 year yields are mixed with yields modestly higher lower