Technical Analysis

Technical Analysis

US 10 year yield now down around 10 basis points at 4.148%

- Technical bias is to the downside.

2025’s Top Five Tech Stocks So Far

- For all those interested in CFD share trading with iFOREX: What are five of the best-performing tech stocks of 2025 so far?

USD makes a run to the downside

- Hopes for less tariffs are good. Stocks higher

The Importance of Patience in Trading

- The best traders aren't the ones who trade the most – they're the ones who trade the smartest.

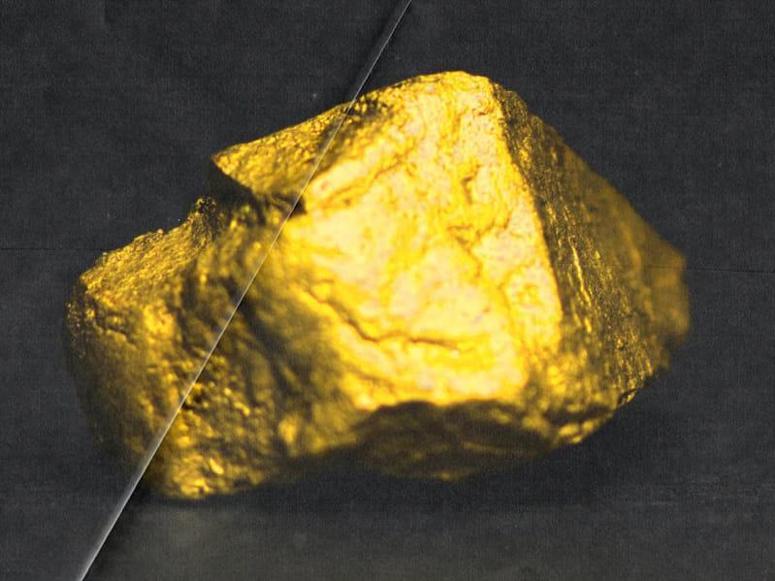

ForexRova Brings Personalization to Gold Trading with Multi-Strategy

- ForexRova’s customizable multi-strategy framework offers traders a personalized experience

USDJPY back up testing the 200 bar MA on the 4-hour chart

- The 200 hour MA is at 149.77

EURUSD dips below the 100 hour MA at 1.0794

- The low has reached 1.0785

FXDyno’s AI-Powered Wave Trading Set to Redefine Gold Trading

- The new trading set accurately identifies and capitalizes on market waves.

Tickmill Doubles Crypto Payouts for Introducing Brokers

- Improved commission structure rewards IBs with higher earnings on crypto trading volumes.

More blood on the street. Liquidation continues led by the Nasdaq stocks

- Nasdaq index now down -2.5%

JBT surges 40% on strong growth, NATR lags with 2.8% revenue growth, FSTR flat sales & 31.4% EPS drop.

PI's 20.2% revenue growth & 49.4% EPS surge at 65.3x P/E; NWPX gains 12.5% revenue, 19.9% EPS at 15.7x P/E; ALNT sales dip 3.2%, EPS down 5.7% at 22.1x P/E.

SCHL's 1.9% growth & poor FCF margin at 18.9x P/E; JXN's 2.5% growth & falling EPS at 0.6x P/B; SFBS's 6.8% EPS growth at 2.1x P/B.

QCOM up 10% YoY, beats estimates, but down 4.2%. ALGM up 14.4%, down 14%. AMD up 35.6%, down 13.7%. INTC up 2.8%, up 5.6%. Traders watch valuations.

HELOC rates at 7.64% offer access to $36T home equity. Watch intro rates vs. variable; shop smart!

VPG's 9% sales decline & 33.6x P/E raise red flags. PINC's 11.8% sales drop & SBCF's flat revenue signal caution.

SLB down 18.9% from high despite strong EPS. Analysts see 29.9% upside, but watch oil market & int'l revenue.

Top Brokers

Sponsored

Must Read