Fundamental Overview

The USD got a boost last week from the strong US PMIs which lifted Treasury yields and put in question the rate cut in September. Once the market digested the report though and saw that there was more good news on the growth side than bad news on inflation, the USD strength faded as the risk-on sentiment ensued.

The NZD, on the other hand, remains supported from the hawkish RBNZ decision where the central bank pushed further out the timing for a rate cut and even added that they considered a rate hike. Moreover, the risk-on sentiment is supportive for commodity currencies like the NZD, so else being equal, we could see even higher prices ahead.

NZDUSD Technical Analysis – Daily Timeframe

On the daily chart, we can see that NZDUSD eventually bounced on the trendline and extended the rally into new highs. The first target for the buyers should be the swing high at 0.6217 with a further break above it opening the door for a rally into the 0.6370 level. The sellers will need to see the price falling below the trendline to gain more conviction and start targeting a drop back into the 0.6050 level.

NZDUSD Technical Analysis – 4 hour Timeframe

On the 4 hour chart, we can see that more clearly the bounce on the trendline where we had also the 38.2% Fibonacci retracement level for confluence. From a risk management perspective, if we see a pullback from the current levels, the buyers will likely step in around the trendline with a defined risk below it and position for a continuation of the rally into the 0.6217 level. The sellers, on the other hand, should wait for a bearish catalyst or a break below the trendline before piling in with more conviction.

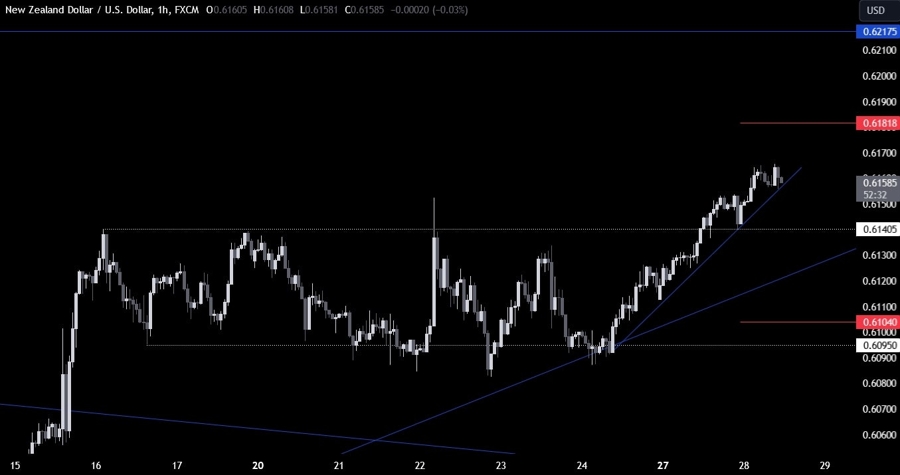

NZDUSD Technical Analysis – 1 hour Timeframe

On the 1 hour chart, we can see that we have a minor trendline which is acting as support for the current bullish momentum. The buyers will likely keep on leaning on it as long as it holds. If the price were to fall below the trendline, it will likely be a signal for a bigger correction with the first target around the major trendline. The red lines define the average daily range for today.

Upcoming Catalysts

Today we get the US Consumer Confidence report where the focus will likely be on the labour market details. On Thursday, we will see the latest US Jobless Claims figures. Finally on Friday, we conclude the week with the US PCE report.