The NZDUSD moved lower (higher USD) like most pairs today in the early US session, but after the US data came out weaker, yields started to move lower helped by regional banking concerns, the trend lower reversed and the price reversed higher.

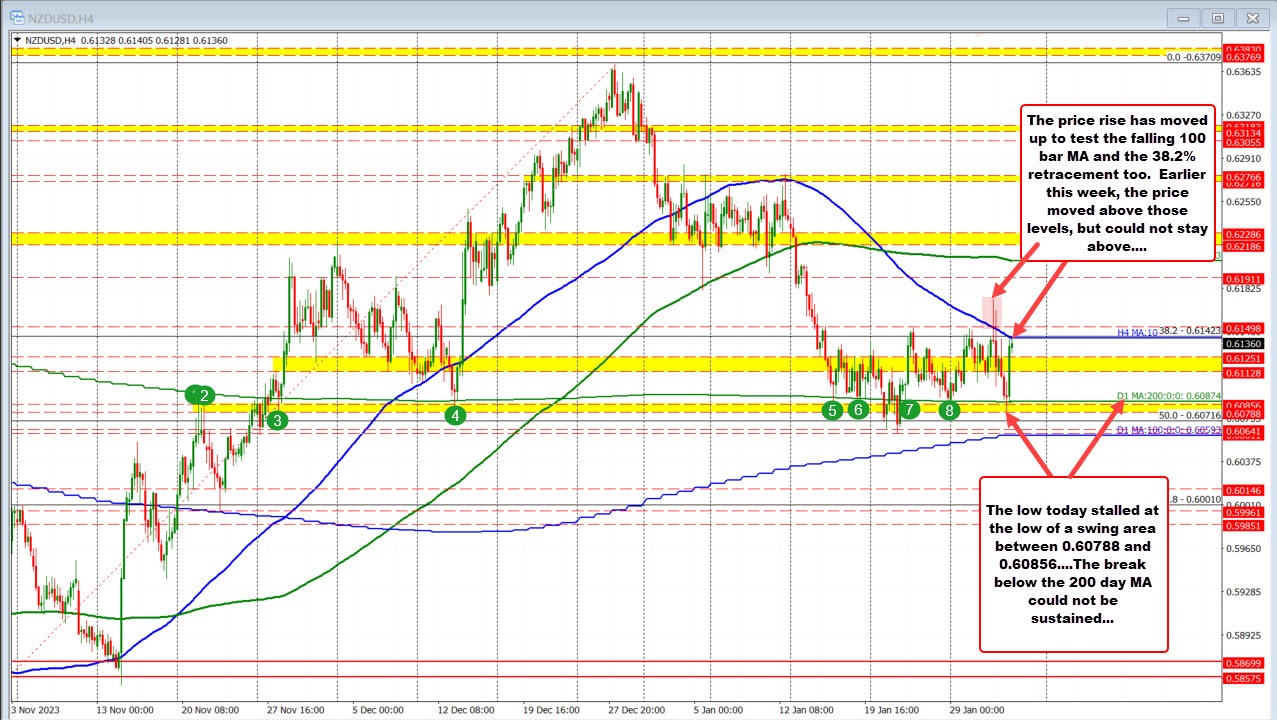

Technically, the low for the day did see the price move below its 200-day MA at 0.60874 but a swing area between 0.6078 and 0.60856 stalled the fall near the low of that range (see green numbered circles). The inability to stay below the 200-day MA (it happened the last two weeks too), turned sellers to buyers.

The subsequent move back to the upside has now taken the price up to test the falling 100 bar MA on the 4-hour chart. That level comes in at 0.61423 and is also home to the broken 38.2% of the move up from the October 2023 low.

If the buyers are to take more control, getting and staying above that area is needed to give the buyers more confidence. Conversely, sellers leaning against the dual technical level would now what to see a move below an old swing area between 0.6112 to 0.6125. Move below and stay below, will have traders looking toward the 200-day MA at 0.60874.