The GBPUSD has waffled up and down in trading today.

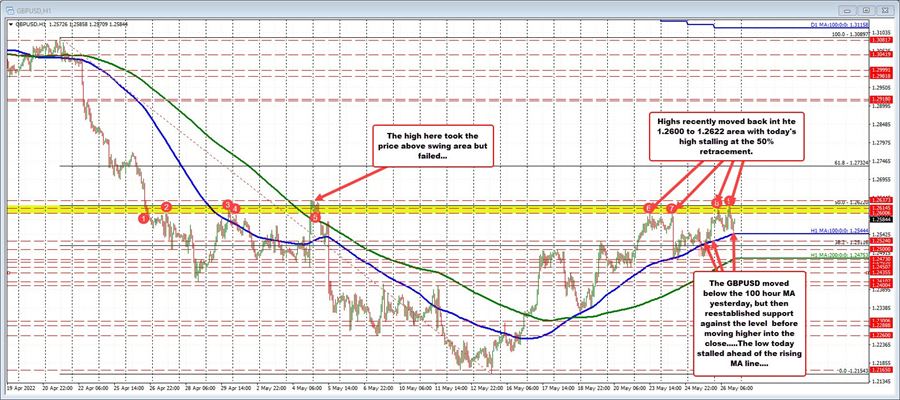

On the topside, the pair found sellers against the 50% midpoint of the move down from the April 21 high. That retracement level comes in at 1.2622. The high price reached 1.2620 - just below that target (there is a swing area from 1.2600 to 1.2622).

On the downside support buyers have come in ahead of the rising 100 hour moving average. That level comes in at 1.2544. The low price in the US session just reached 1.2552. Recall that yesterday, the price did dipped below the 100 hour moving average, but then moved back above it in the US session and stayed above the risk defining level. That gave the buyers the go ahead to push toward the upside targets today.

Taking a broader look, since reaching the cycle low at 1.21543 on May 12, the price has been up 7 of the last 9 trading days. The current price is trading near unchanged. In the intermediate-term, the buyers are winning above the 100 hour moving average, but with resistance holding at the 50% midpoint, there is more to prove.

So....battle lines have been drawn by the buyers and sellers in the GBPUSD. Ultimately, those battle lines will help to crown winner. For now, however, with the price trading near the middle of the levels, the shorter-term intraday biases were neutral as the battle rages.