Fundamental Overview

The USD continues to lose ground as the tariffs fears ease. In fact, tonight Trump said that he would rather not use tariffs on China which triggered more weakness in the greenback.

The tariffs risk has been the only thing keeping a bid under the US Dollar after the US inflation data, so when that risk eases, the greenback weakens.

On the GBP side, the UK PMIs today jumped to a 3-month high although S&P Global noted that the economy faces a stagflationary scenario amid jobs shedding and increased inflationary pressures.

Despite that, the market continues to expect a rate cut at the upcoming meeting and a total of 67 bps of easing by year end.

GBPUSD Technical Analysis – Daily Timeframe

On the daily chart, we can see that GBPUSD is rejecting the major trendline as the sellers are stepping in with a defined risk above the trendline to position for a drop into the 1.2040 level. The buyers will want to see the price breaking higher to gain more conviction and increase the bullish bets into the 1.28 handle next.

GBPUSD Technical Analysis – 4 hour Timeframe

On the 4 hour chart, we can see that we now have an upward trendline defining the current bullish momentum. If the price were to pull back into it, we can expect the buyers to lean on the trendline to position for a break above the major trendline. The sellers, on the other hand, will want to see the price breaking lower to increase the bearish bets into new lows.

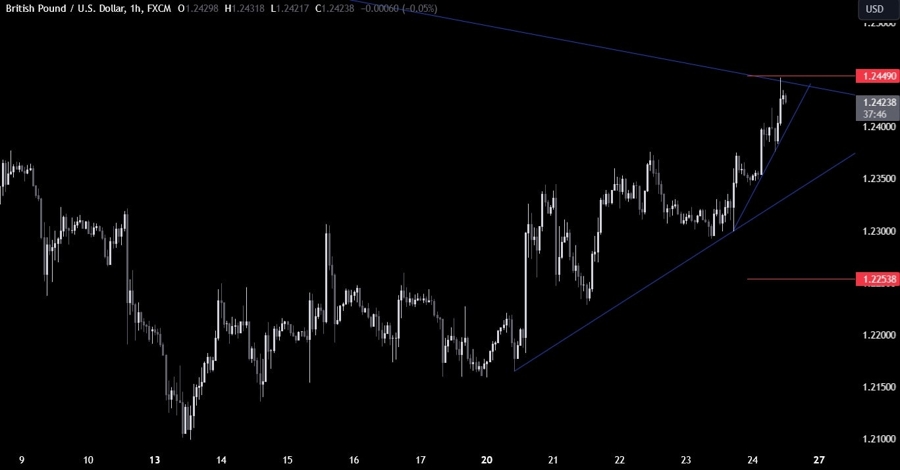

GBPUSD Technical Analysis – 1 hour Timeframe

On the 1 hour chart, we can see that we have another minor upward trendline defining the bullish momentum on this timeframe. The buyers will keep on leaning on it to push into new highs, while the sellers will look for a break lower to increase the bearish bets into the next trendline. The red lines define the average daily range for today.

Upcoming Catalysts

Today we conclude the week with the Flash US PMIs.