UPCOMING EVENTS:

Tuesday: US CPI.

Wednesday: US PPI.

Thursday: ECB Policy Decision, US Jobless Claims.

Last week the events concerning the Silicon Valley Bank overshadowed the economic data and the more hawkish pricing of the market. SVB specialised in banking for startups and provided financing for almost half of US venture-backed technology and health-care companies.

It was among the top 20 commercial banks in the US with more than $200 billion in total assets. Long story short, SVB faced a bank run and in 48 hours it collapsed making it the second largest bank failure in US history.

The collapse of the bank raised contagion fears among market participants and we saw a quick repricing lower of both the 50 bps rate hike at the March meeting and the terminal rate. The market now sees a higher chance of a 25 bps hike at the coming meeting and a 5.25-5.50 terminal rate. This change in pricing comes from the market expecting tighter financial conditions from now on due to the failure of SVB.

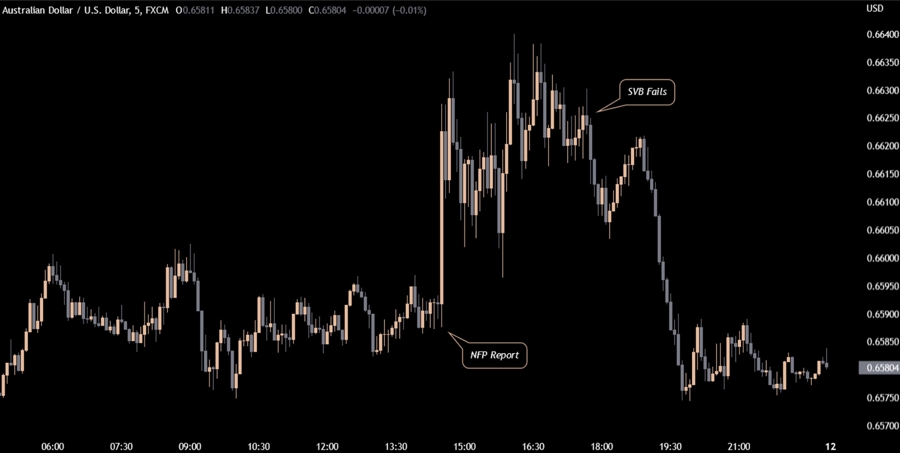

The reaction in the FX market on Friday was two sided. On one hand, the higher than expected unemployment rate and lower than expected wage gains in the NFP report, made the market to reprice a bit lower the hawkish bets and this caused the USD to weaken initially.

On the other hand, as risk sentiment soured due to the failure of SVB and contagion fears, the USD gained due to the flight to safety. Below you can see the price action in AUD/USD on Friday.

AUD/USD 5 minutes chart

Given that we are at a point where the soft landing scenario keeps evaporating day by day, risk sentiment can turn south at any moment and in FX the best place in such environments are the safe haven currencies like the USD, the JPY and the CHF. So, if one wants to short the USD, in case CPI misses or something breaks in the economy making bond yields to fall, it would be better to express that view shorting USD/JPY or USD/CHF, because the US Dollar can still appreciate versus the other currencies as a safe haven.

*Last night the Treasury and the Fed announced that depositors money will be protected in full and the Fed created an emergency lending facility called Bank Term Funding Program (BTFP). This swift and strong action calmed the markets, and it should give the Fed the greenlight to keep with their rate hikes.

Tuesday: The US CPI is without doubt the biggest event of the week and it will most likely decide how much the Fed is going to hike at their March meeting and what terminal rate they will project in the Dot Plot. The headline Y/Y is expected at 6.0% vs. 6.4% prior and the M/M reading is expected at 0.4% vs. 0.5% prior. The Core Y/Y figure is expected at 5.5% vs. 5.6% prior and for the M/M the forecast is unchanged at 0.4%. Given the recent events with the failure of Silicon Valley Bank, the market may want to see a notable beat to price in a 50 bps hike and the Fed, as it has always done, will follow market consensus as it doesn’t want to surprise.

Wednesday: Fed Chair Powell also flagged the PPI among JOLTS, NFP and CPI reports for the decision between 25 and 50 bps hike at the March meeting. The headline Y/Y reading is expected at 5.4% vs. 6.0% prior and the M/M at 0.3% vs. 0.7% prior. The Core figures are expected at 5.2% vs. 5.4% prior for the Y/Y and 0.4% vs. 0.5% prior for the M/M one.

Thursday: Given the recent comments by ECB members and the hot inflation data, the ECB is widely expected to hike by 50 bps bringing the deposit rate to 3.0%. The market expects the ECB to reach 4.0% for their terminal rate, although this can change easily if inflation remains stubbornly high. No changes are expected to the balance sheet rundown of 15bln/month in APP reinvestments.

Given the high focus on the labour market, as it was made clear by the market reaction last week to a miss in the data, jobless claims will also be a key report this week on a forward looking basis. Initial Claims are expected at 205K vs. 211K prior and Continuing Claims are expected at 1659K vs. 1718K prior. Given the context, a notably higher than expected number should be good for the bond market with yields lower, and bad for the USD and commodities. For the stock market the reaction function is trickier at the moment. Generally, when unemployment starts to rise as a consequence of a recession, it’s bad for the market at the initial stages, no matter if you expect the Fed to cut rates next.

S&P500 vs. Unemployment Rate

This article was written by Giuseppe Dellamotta.