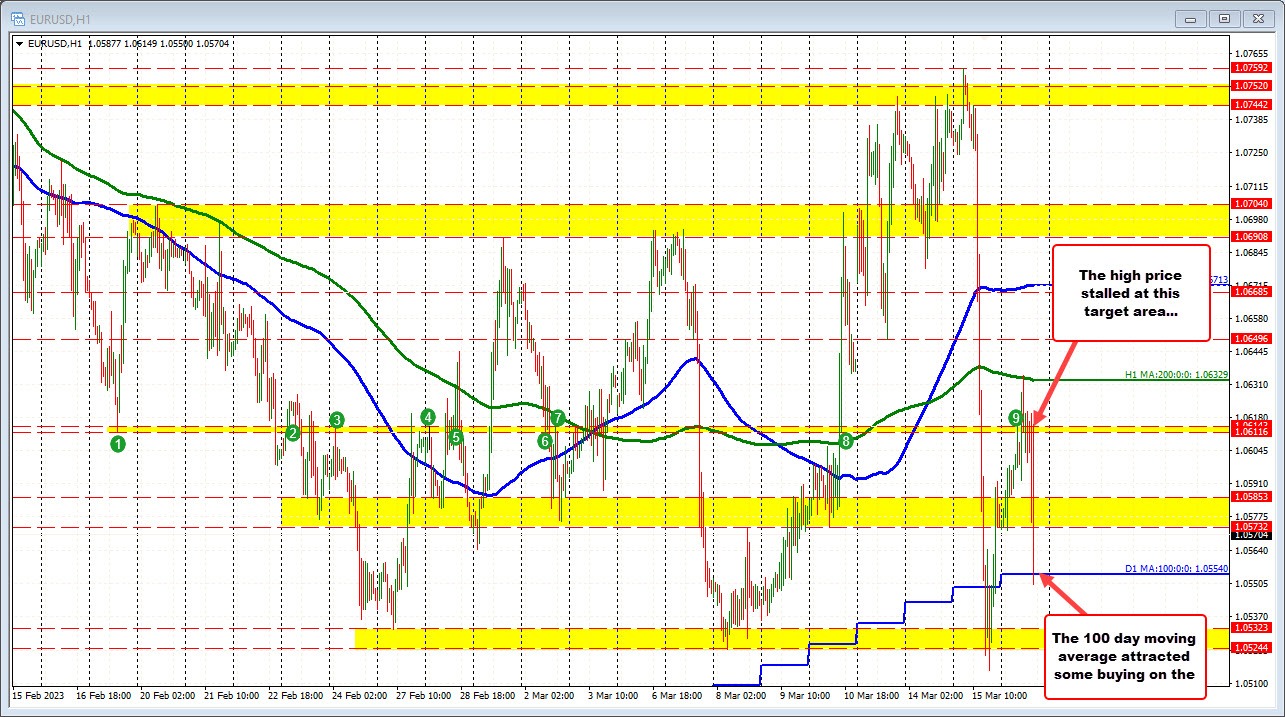

The European Central Bank (ECB) raised interest rates by 50 basis points, an outcome the market had assigned a 37% probability just before the announcement. As a result, the EUR/USD initially climbed but encountered resistance near the 1.0612 area, which was identified as a modest resistance target (see previous post). The upward momentum then subsided, causing the price to reverse and test its 100-day moving average of 1.0554 (lower blue step line on the chart above). The low price dipped just below this level at 1.0550 before bouncing back.

Amid these fluctuations, a key swing area remains between at 1.0573 to 1.0585. Currently, the price is hovering within this range as the market reacts to post-decision volatility. Traders await the next shove (likely helped by something Lagarde says).

Key levels remain the same:

- ON the topside, the 1.0612 and then the 200 hour MA at 1.06329 will be targeted

- On the downside, moving below the 100 day moving average at 1.0554 (and staying below), would have traders targeting a swing area between 1.0524 and 1.0532. Below that the swing low from yesterday's tray came in at 1.0515.

Market participants now await ECB President Christine Lagarde's press conference (starting at 9:45 AM ET), during which she will address questions from journalists. As a result, traders should anticipate heightened volatility throughout this event.