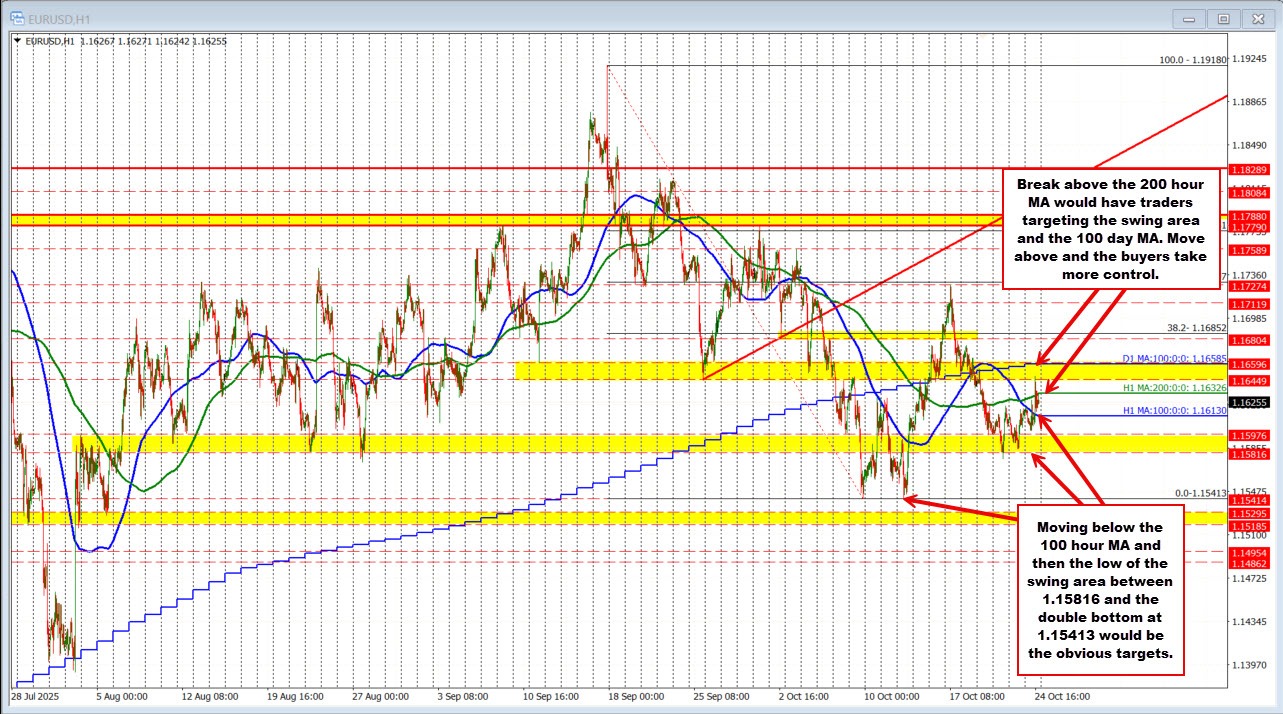

The EURUSD traded both lower and higher today, extending to the upside after the weaker U.S. CPI data. However, sellers leaned against a swing area between 1.1645 and 1.1659, capping the move and sending the pair back down. The price has since settled back between the 100 and 200 hour MAs (blue and green lines) between 1.1613 and 1.1633, with the current price around 1.1626.

With the pair now trapped between the moving averages, the technical bias is neutral heading into the weekend. Next week, traders will be looking for a clear break in either direction — and follow-through momentum.

On the upside, a move above the 200-hour MA at 1.1633 opens the door to the 1.1645–1.1659 zone, which also aligns with the 100-day MA. Holding above that level would tilt the bias more bullish.

On the downside, a break below the 100-hour MA at 1.1613 targets the 1.1581–1.1597 area. A move under that zone would shift focus toward the double bottom from October near 1.1541.

The roadmap is clear — it’s all about which side wins the breakout. In today’s video, I walk through these key levels, the bias, and the risk markers that traders should keep front and center.