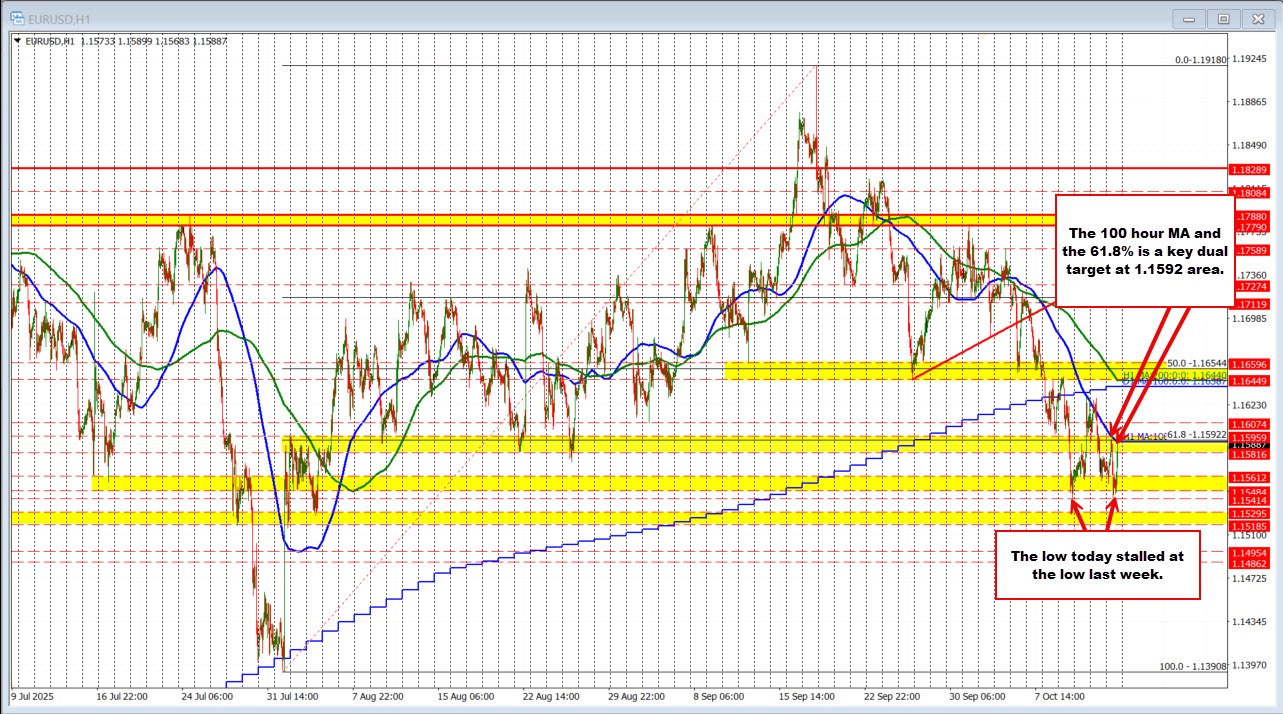

The EURUSD began the US session trading near the lows for the day, hovering just above the low from last week at 1.15414. Sellers made several attempts to push the pair below that level, but each effort failed to generate sustained downside momentum. Once the price started to trade more comfortably above the top of the nearby swing area at 1.15612, sentiment shifted — sellers turned to buyers, sparking a rebound.

That upside push carried the pair toward the next key swing area between 1.1581 and 1.15959. The critical level within that zone is the falling 100-hour moving average at 1.1592, which also coincides with the 61.8% retracement of the move up from the August 1 low. The overlap of these two technical markers makes this area particularly important.

A break and hold above 1.1592 would likely open the door for further upside momentum, as it would signal a shift in near-term control back to the buyers. Conversely, failure to extend above and a rotation back below 1.1561 would keep the broader downtrend from the September high intact, leaving sellers in control of the technical narrative for now.