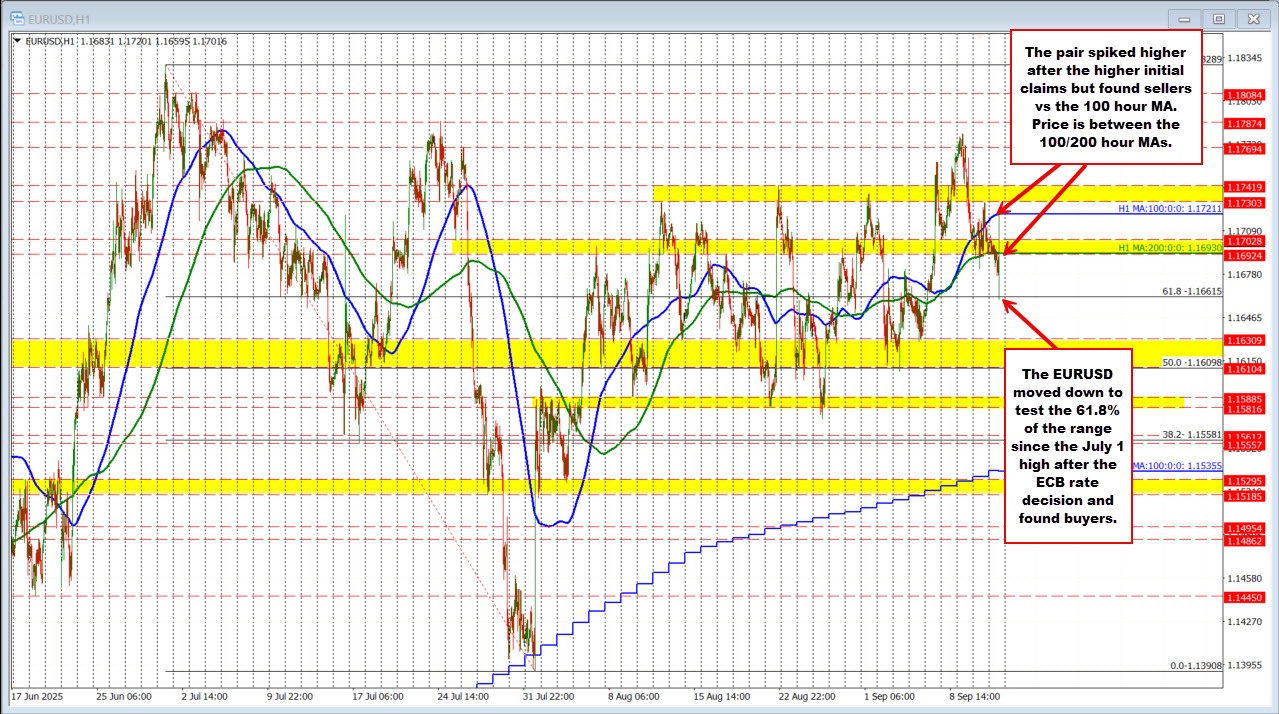

The EURUSD has been whipsawed in the wake of the ECB rate decision and a stronger-than-expected initial jobless claims report. The first reaction came on the downside, with sellers pressing the pair toward the 61.8% retracement of the move down from the July 1 high, a key level at 1.16615. Buyers held the line there, sparking a rebound.

That rebound gained traction after the U.S. data, lifting the pair back above the 200-hour moving average at 1.1693 and up to test the 100-hour moving average at 1.1721. Sellers, however, defended that first look against the 100-hour average, halting the upside momentum and forcing the price back toward the 200-hour MA.

With the pair now caught between the 100-hour and 200-hour moving averages, the market is once again sitting in neutral territory. Traders will look to a break on either side of these bias-defining moving averages to set the next directional move.

Lagarde's press conference could bring additional volatility as the market channels between EU and US fundamentals.