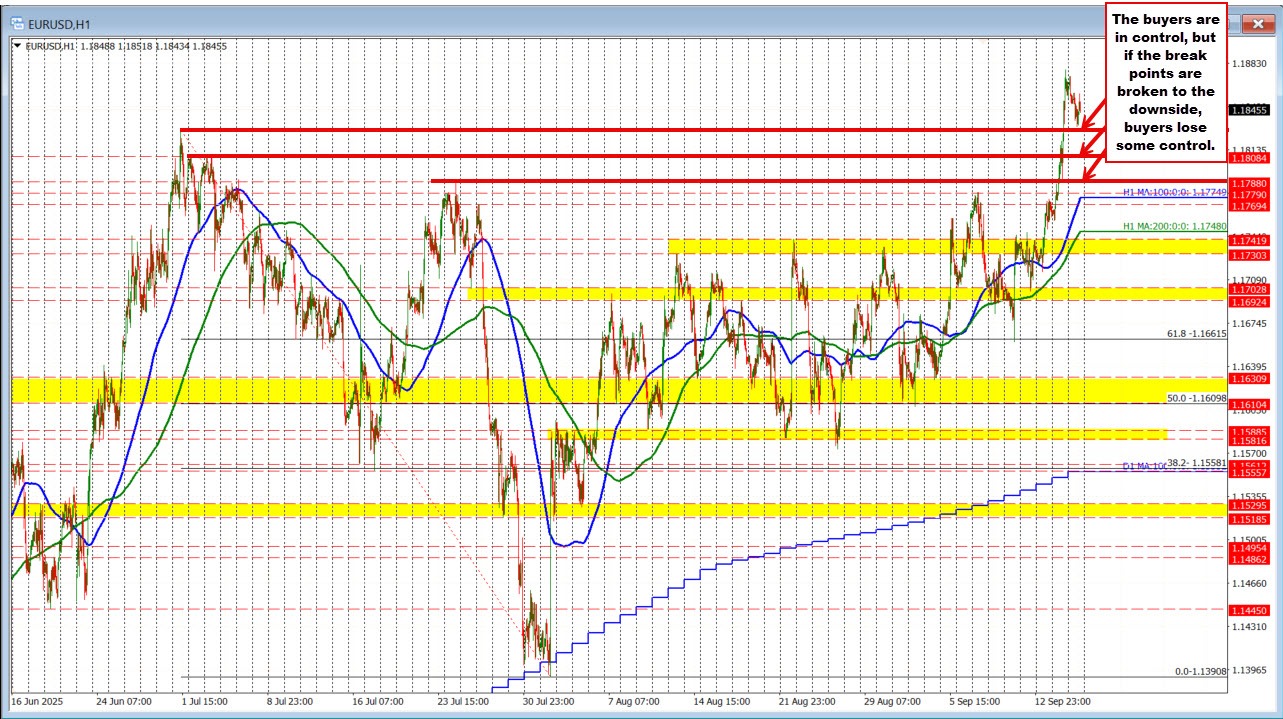

The EURUSD surged higher yesterday, breaking to new highs for the year above 1.1829 and reaching its strongest level since 2021. The bullish momentum carried the pair to a peak of 1.1879 before price action rotated lower into the close.

In my post yesterday on the EURUSD, I wrote:

The low price today did find buyers defending the 1.18189 level. The low price reached 1.1832 before bouncing higher.

What now?

With the price successfully holding a base at support, that level takes on even greater technical importance. A decisive break below would shift sentiment, giving buyers “cause for pause” and handing sellers a short-term technical victory. The first downside target on such a move would be 1.1808, followed by the July 24 swing high at 1.1788.

As long as the support holds, however, buyers remain firmly in control. On the topside, the next key hurdle comes in at 1.1909 — a double swing high from July 30, 2021 and September 3, 2021. A sustained break above that level would open the door for further upside momentum and strengthen the bullish bias.

The video above outlines the key levels explains all reasons for bias, risks, and targets.